Appendix A : Transaction Parameters

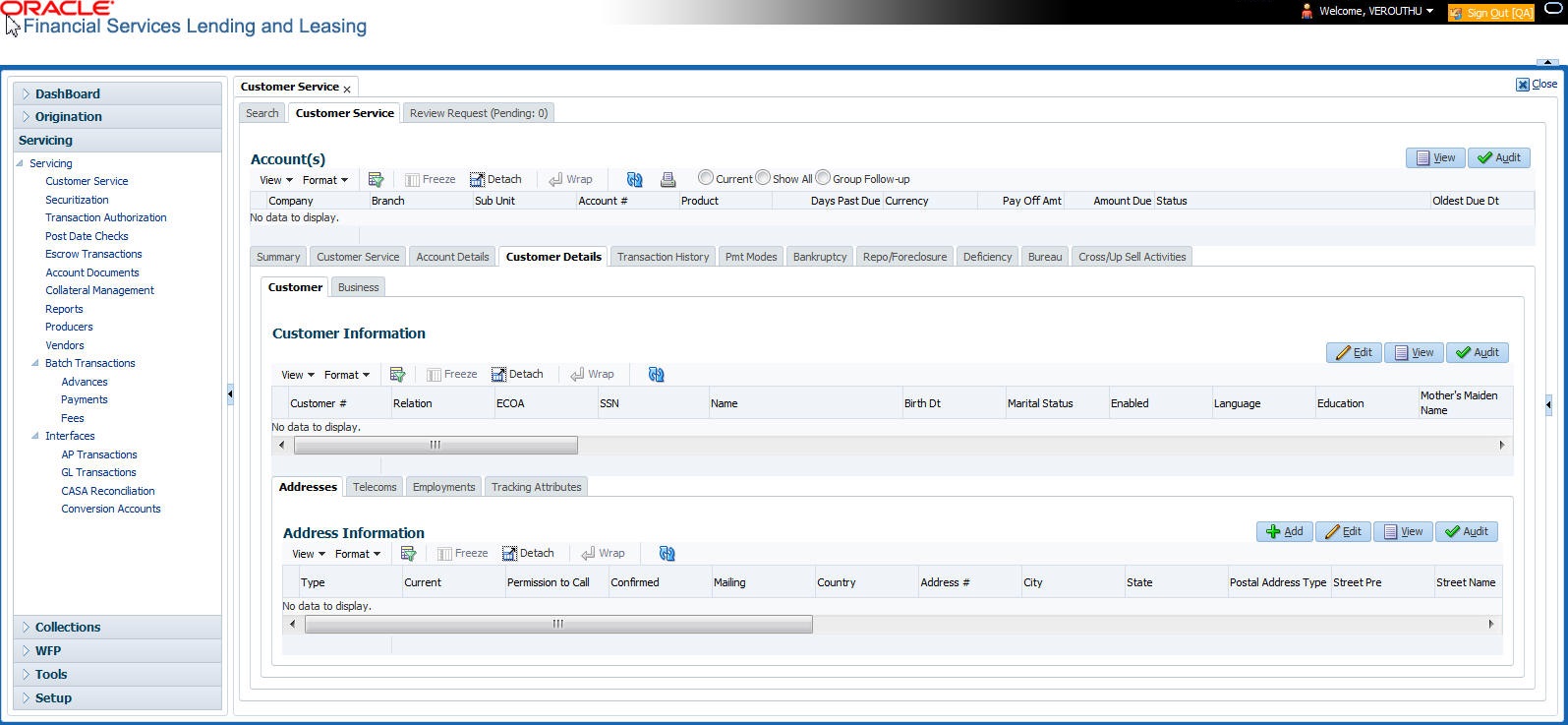

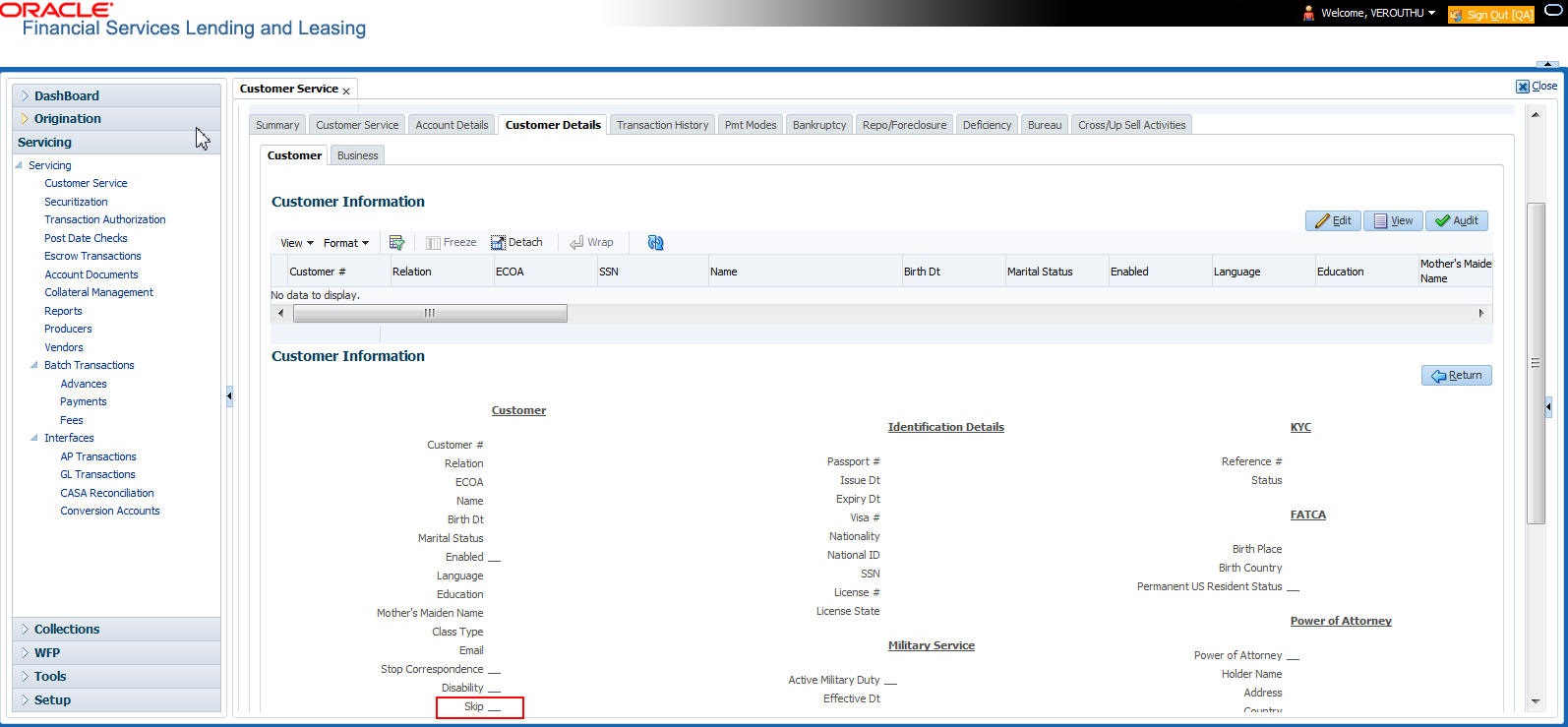

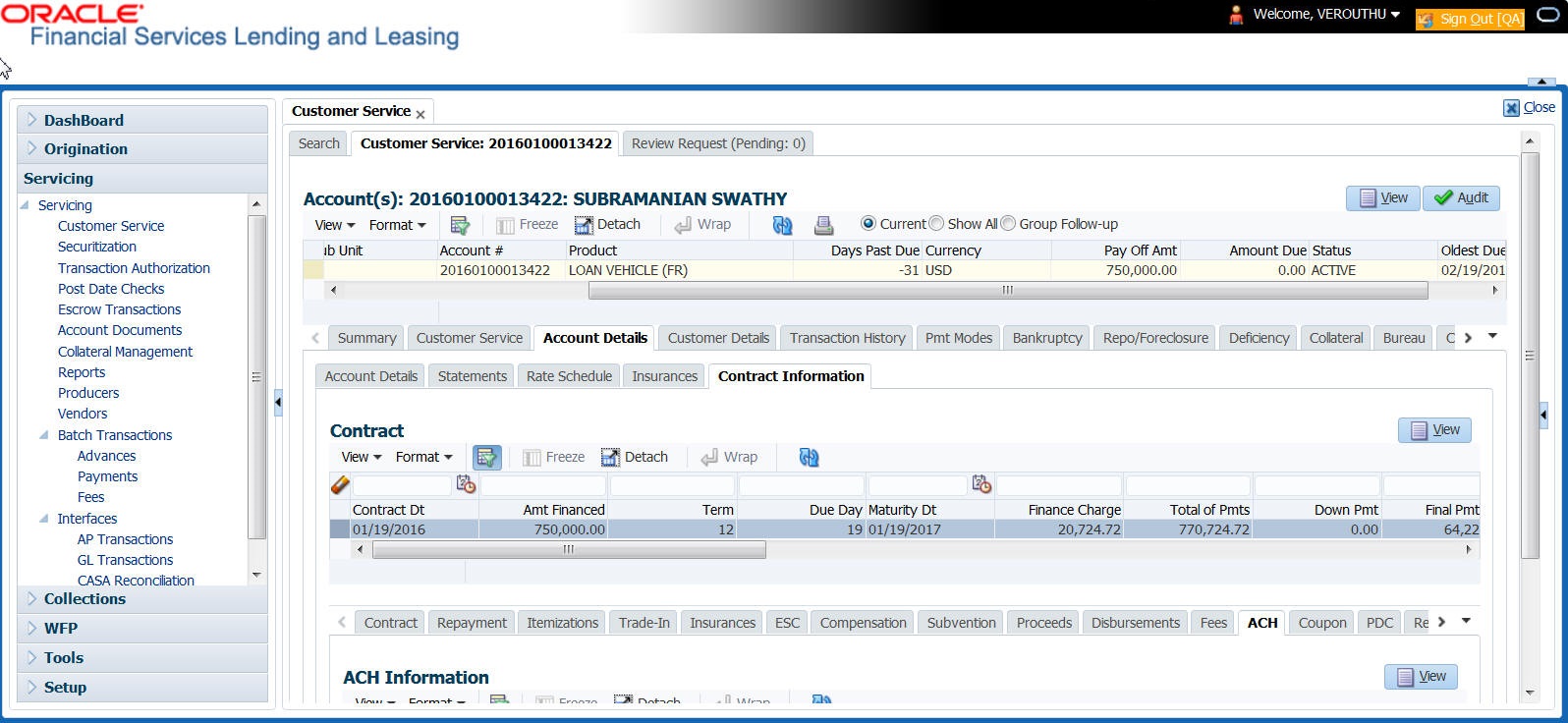

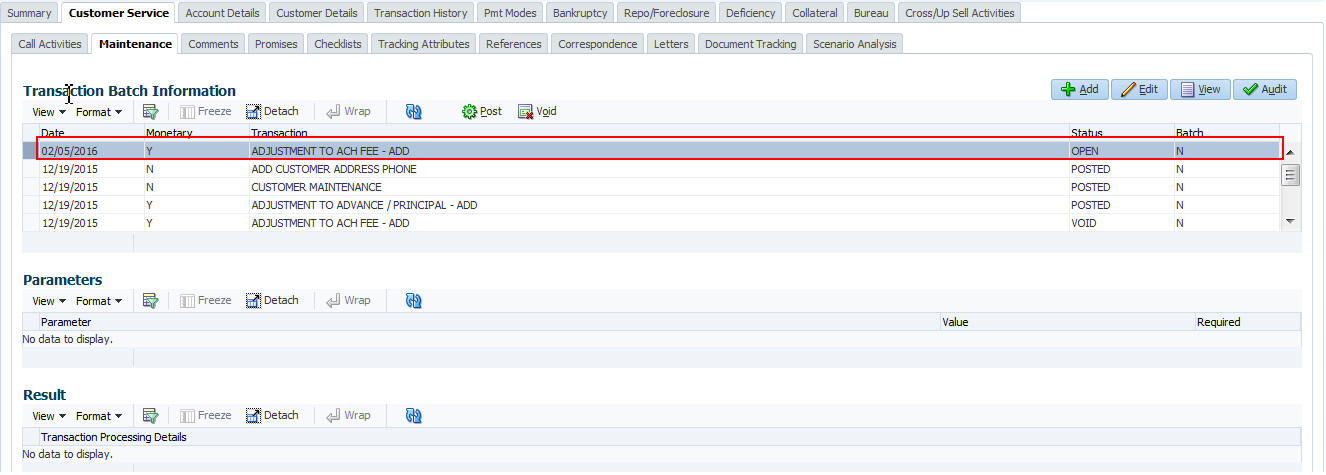

The Customer Service screen’s Maintenance sub tab enables you to post an array of monetary and nonmonetary transactions for any given account. The transactions that are available depend on responsibility of the Oracle Financial Services Lending and Leasing user, nature of account, and whether the account is a Line of credit.

Appendix A : This appendix catalogues the baseline transaction codes and parameters available on Customer Service screen’s Maintenance sub tab. Instructions on how to use the Maintenance sub tab are located in Customer Service chapter of this User Guide.

A.1 Monetary Transactions

This section catalogues the transaction codes and parameters required to complete the following monetary tasks for Line of credit:

- Apply, adjust, or waive servicing expenses

- Adjust or waive late charges

- Adjust or waive nonsufficient funds

- Apply, adjust, or waive repossession expenses

- Apply, adjust, or waive bankruptcy expenses

- Apply or adjust phone pay fees

- Change an index/margin rate

- Apply, adjust, or cancel financed insurance

- Generate a payoff quote

- Payoff an account

- Charge-off an account/Do Not Charge-Off an account

- Close an account

- Apply, adjust, or waive an extension fee

- Adjust or waive a prepayment penalty

- Reschedule an escrow payment

- Adjust or waive an escrow payment

- Adjust or waive a payoff quote fee

- Place an account in a nonperforming condition

- Reverse a nonperforming condition

- Reschedule precomputed Line of credit to interest bearing Line of credit

- Change profit rate

- Refunding the payment

- Non Refund GL

- ACH Fee Maintenance

- Adjust, charge-off, or waive the advance/principal balance

- Adjust the interest balance

- Stop interest accrual

- Indicate a borrower as on or off active military duty

- Trading of Accounts - Monetary Transactions

- Billing Cycle Change

- Capitalization Maintenance

- Fee Consolidation Maintenance

- Cycle Based Late Fee Adjustment / Waiver

Note

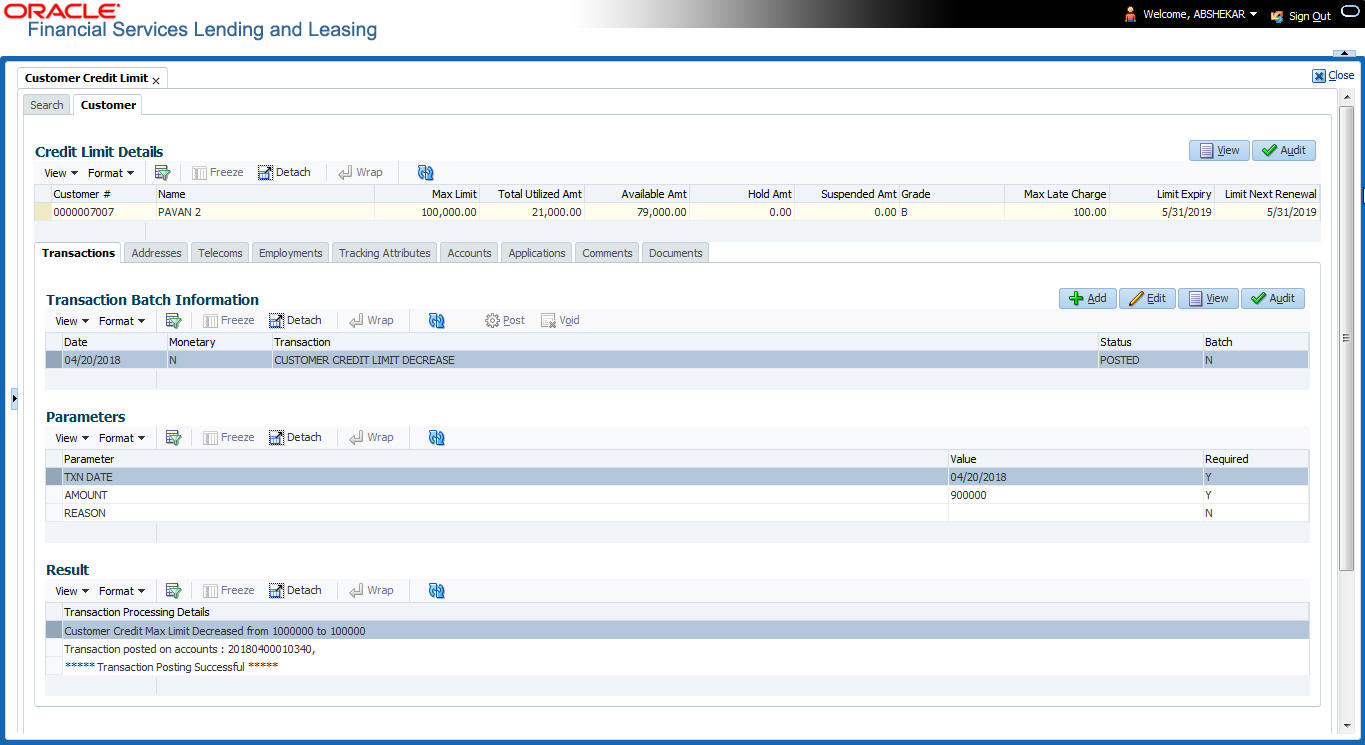

- While posting any monetary transaction that results in increase of account maturity date, system auto validates if the same is within the 'Customer Credit Limit Expiry date' of any one or all of the customer(s)/business who contributed for funding the Account. In case it is greater, system displays an error indicating that the resulting Maturity date is greater than 'Customer Credit Limit Expiry date' and does not allow to post the transaction.

- OFSLL does not allow to post any monetary transaction on/or prior to the status change date. However, in case if the ACH gets the payment return file with NSF (no-sufficient funds) payment status - where the account status is ‘PAID OFF’, system automatically reverses the PAID OFF status and posts the NSF transaction on account.

A.1.1 Late Charges

Late charges occur when payment is not made within the grace period or by the day after payment is due. The due date is determined by the contract.

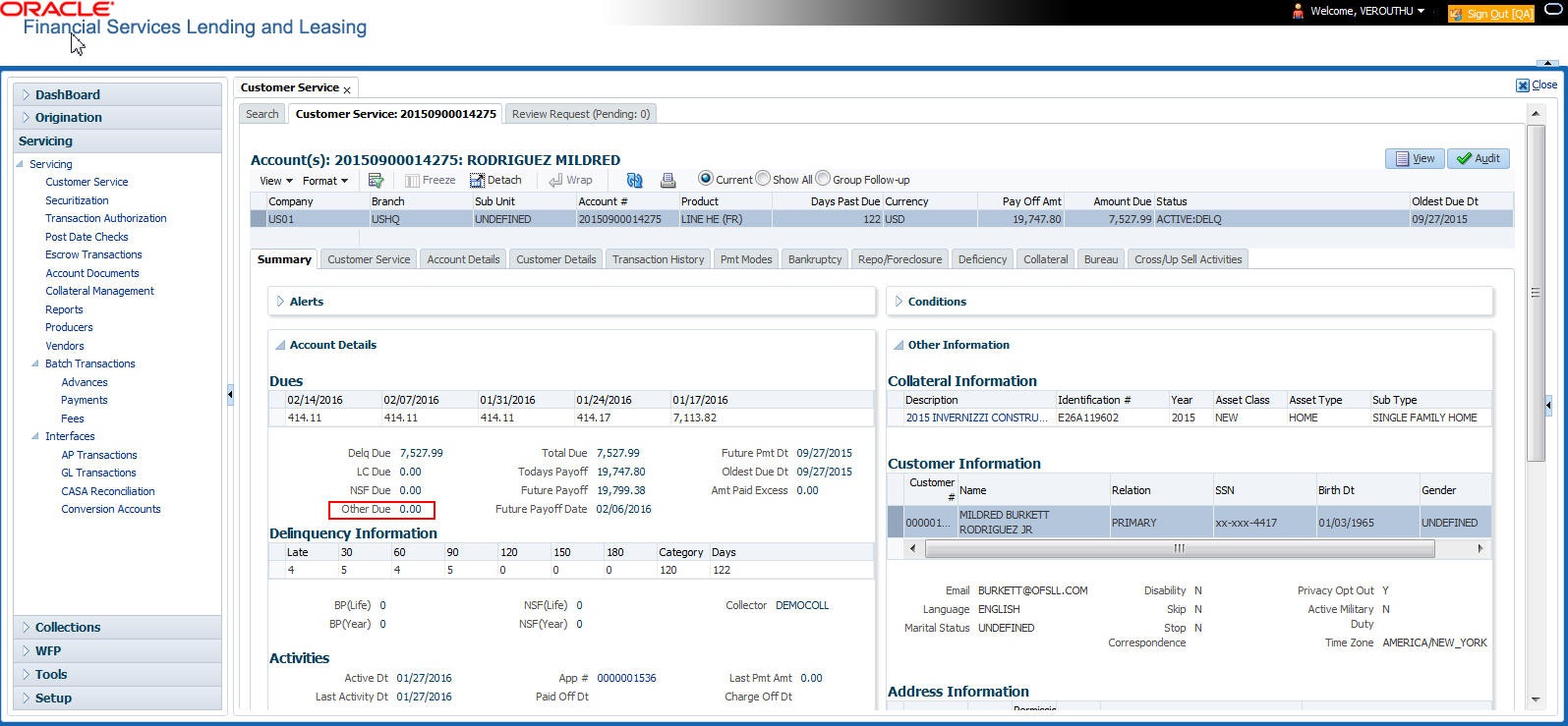

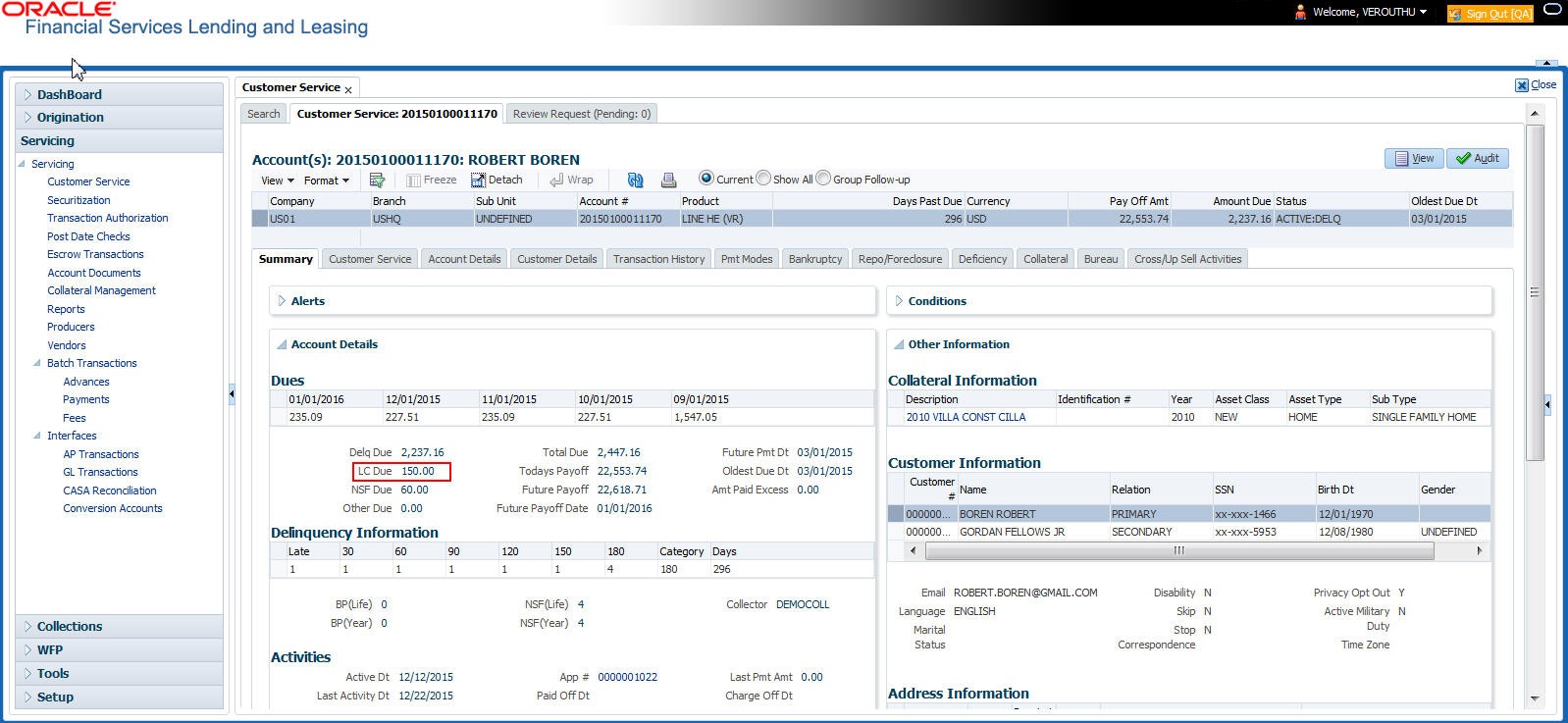

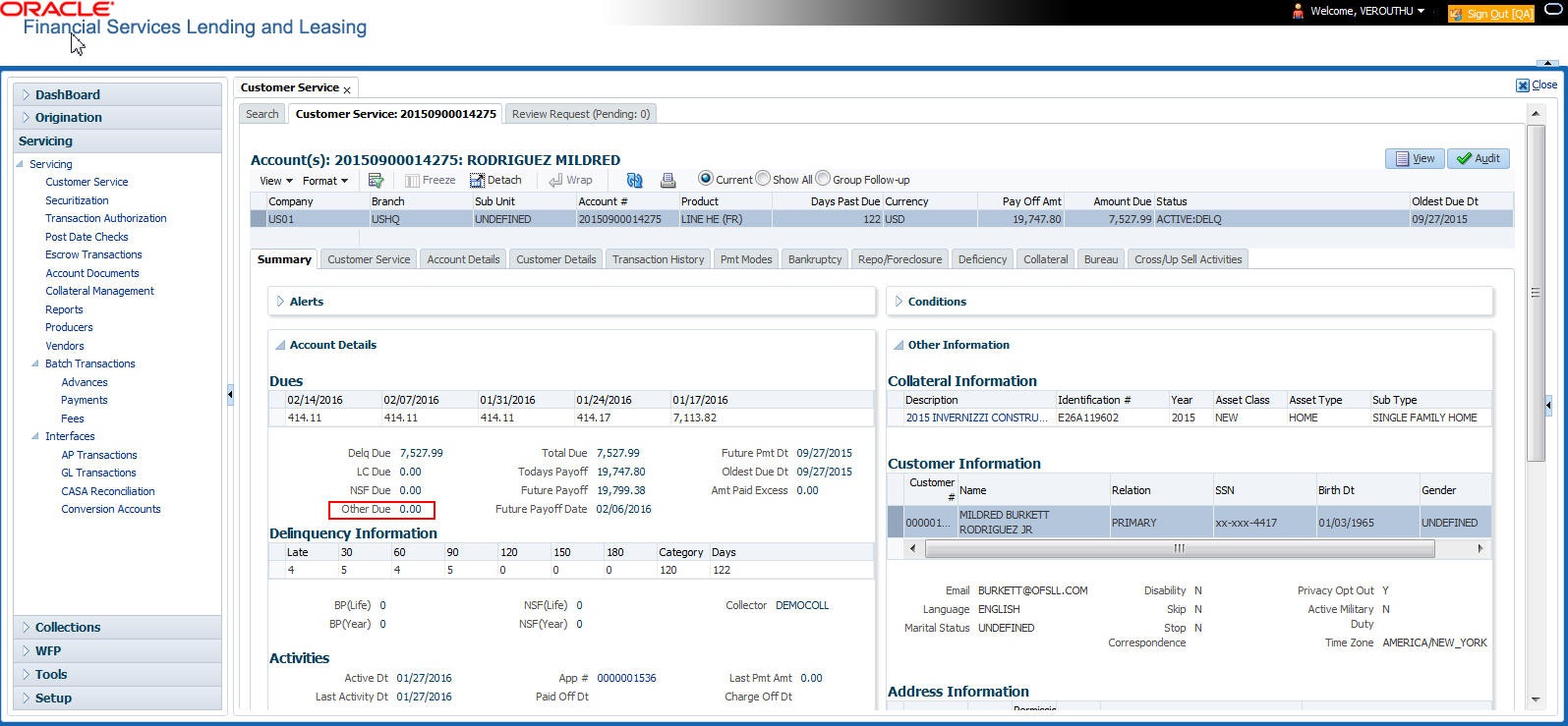

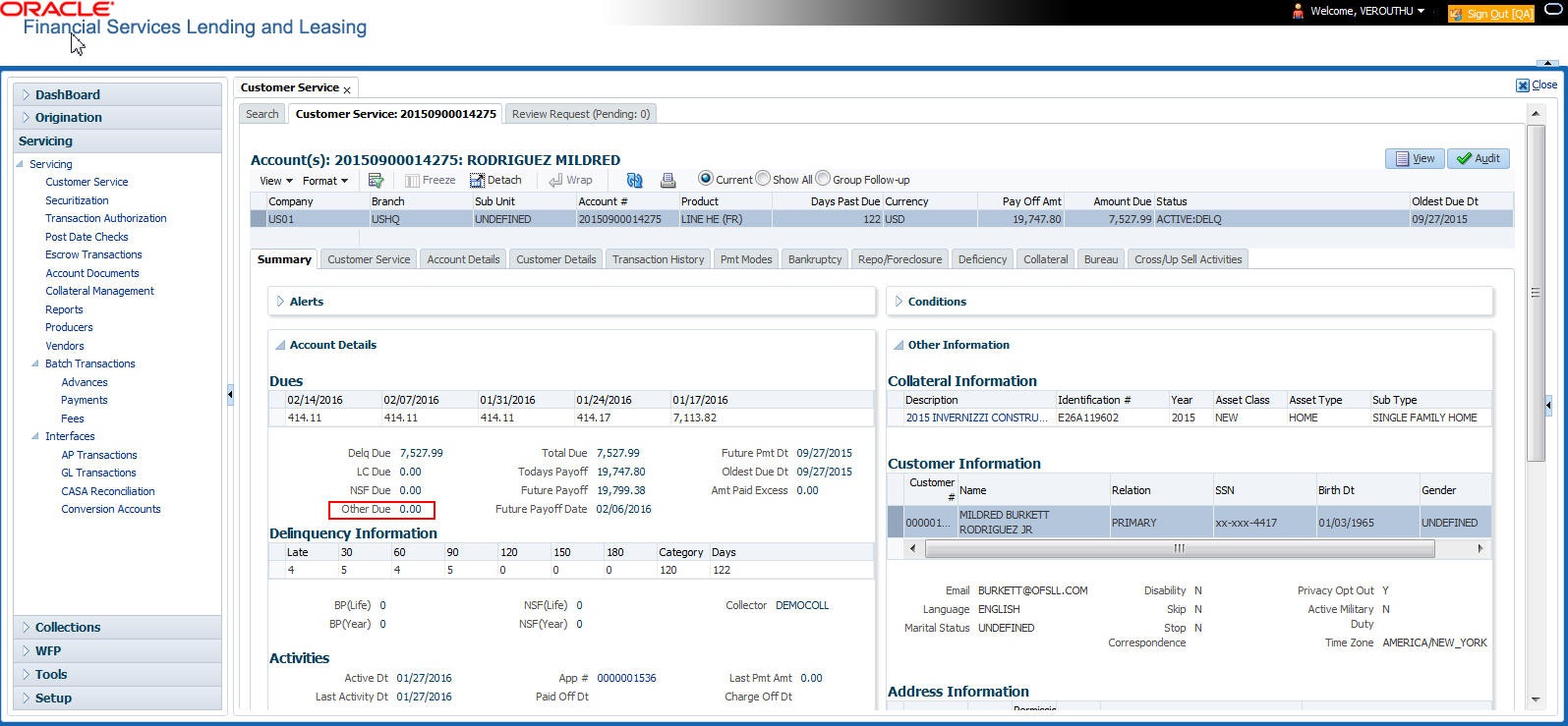

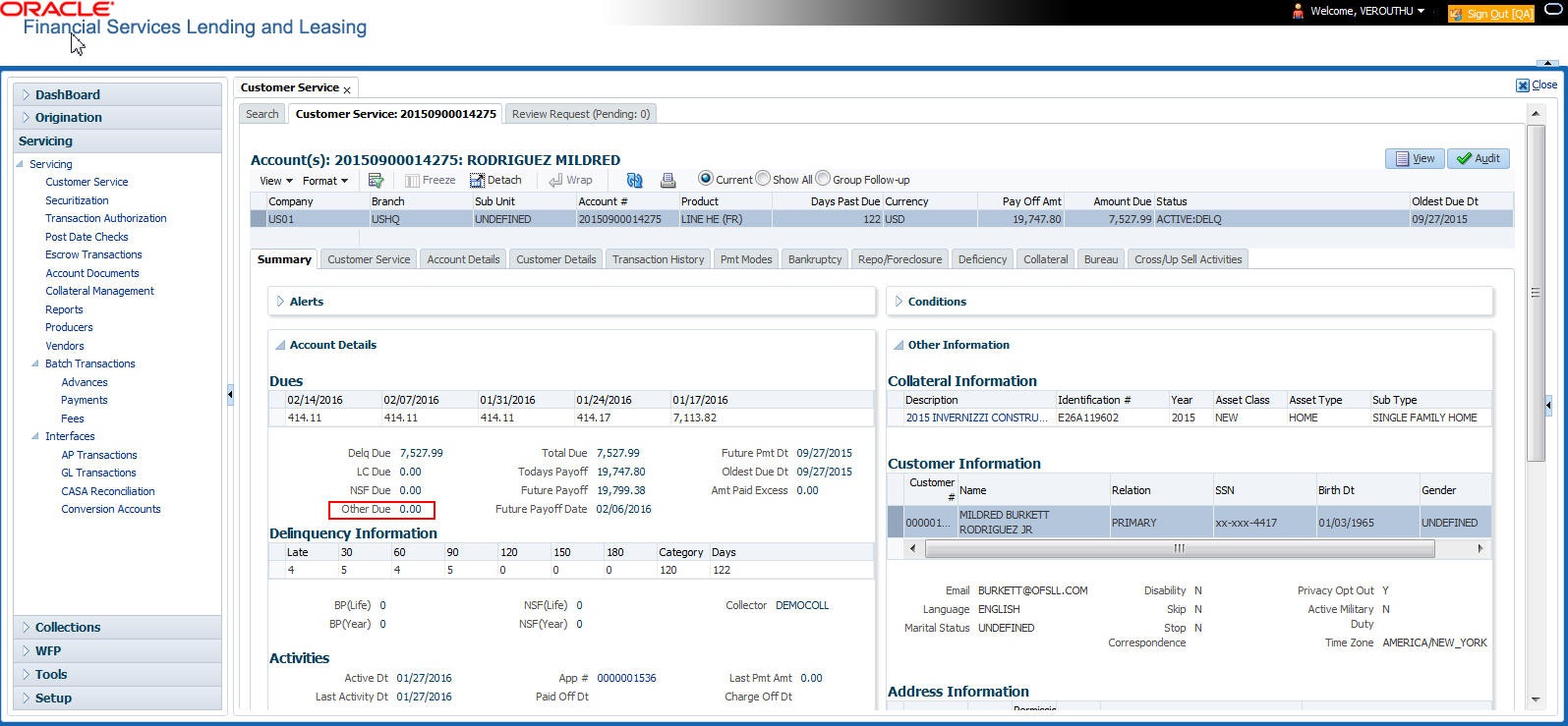

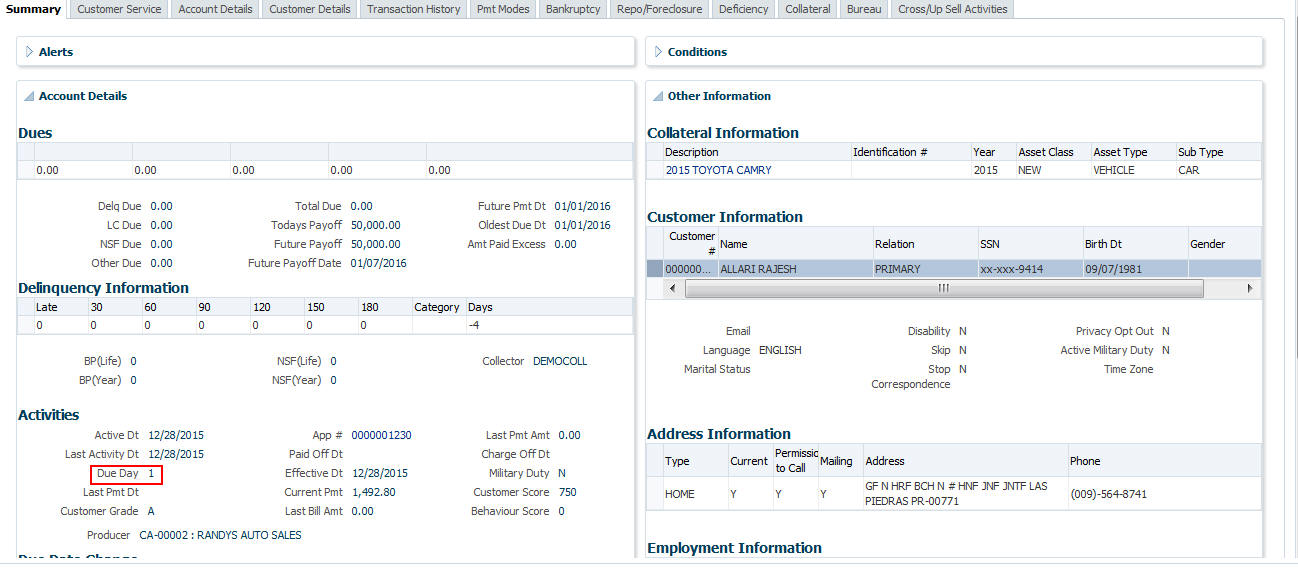

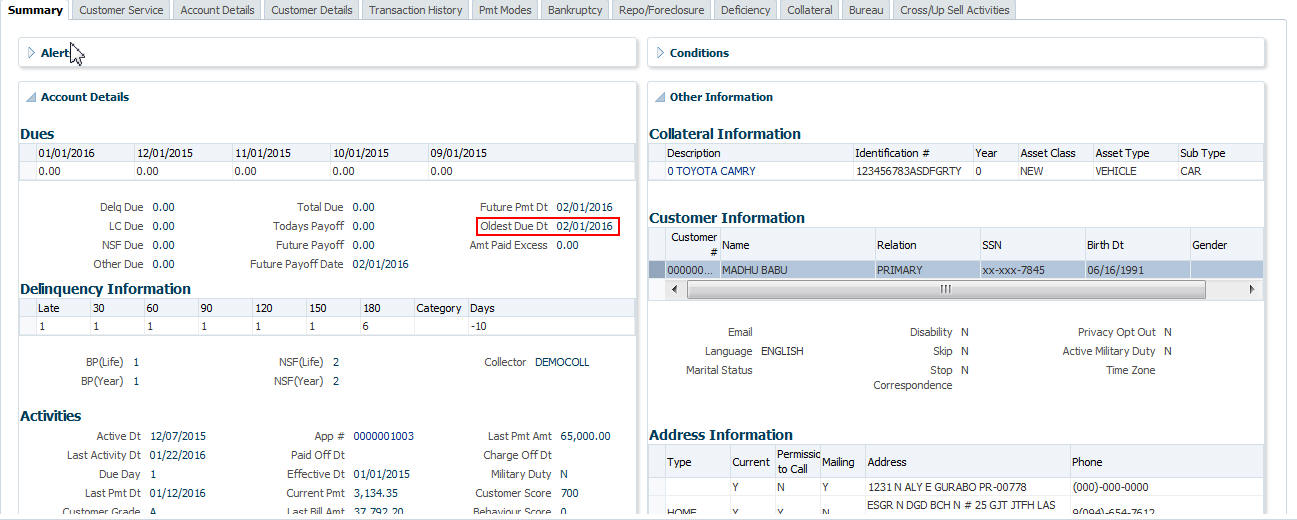

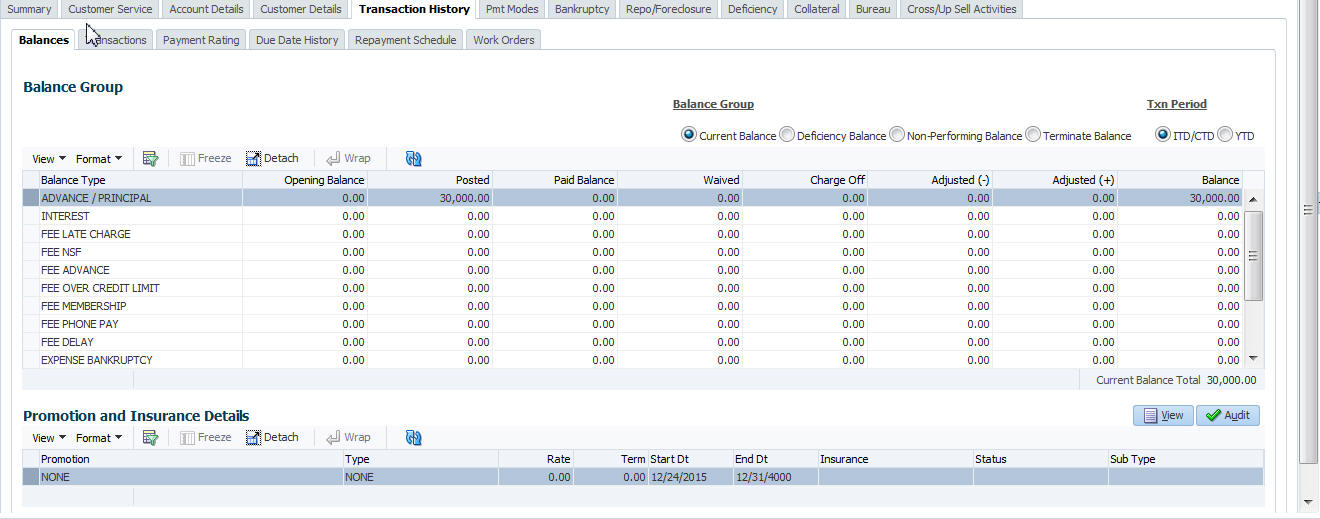

Late charges appear in LC Due field on the Dues section of Summary tab of the Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a late charge

Transaction |

Parameters |

Adjustment To Late Charge - Add |

Txn Date Amount |

Adjustment To Late Charge - Subtract |

Txn Date Amount |

To waive a late charge

Transaction |

Parameters |

Waive Late Charge |

Txn Date Amount |

A.1.2 Nonsufficient Fund Fees

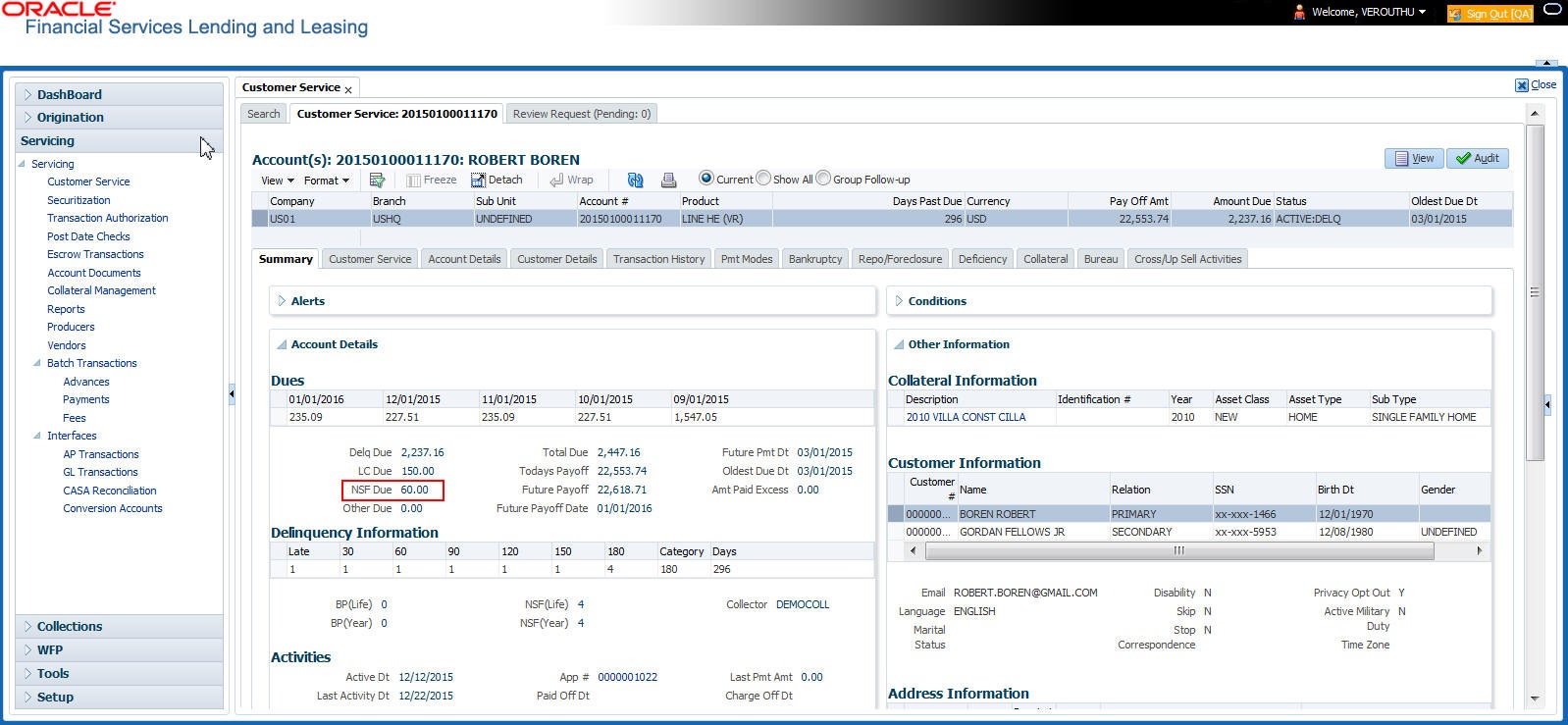

Nonsufficient fund fees are posted when a payment does not cover the amount owed. The fee that the system automatically applies to an account is recorded during setup.

Nonsufficient fund fees appear in the NSF Due field on the Dues section of Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a nonsufficient funds

Transaction |

Parameters |

Adjustment To Nonsufficient Fund Fee - Add |

Txn Date Amount |

Adjustment To Nonsufficient Fund Fee - Subtract |

Txn Date Amount |

To waive a nonsufficient funds

Transaction |

Parameters |

Waive Nonsufficient Fund Fee |

Txn Date Amount |

A.1.3 Repossession Expenses

Repossession expenses include any costs incurred while obtaining the asset, including legal fees or storage costs.

Repossession expenses appear in Other Due field on the Dues section of the Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

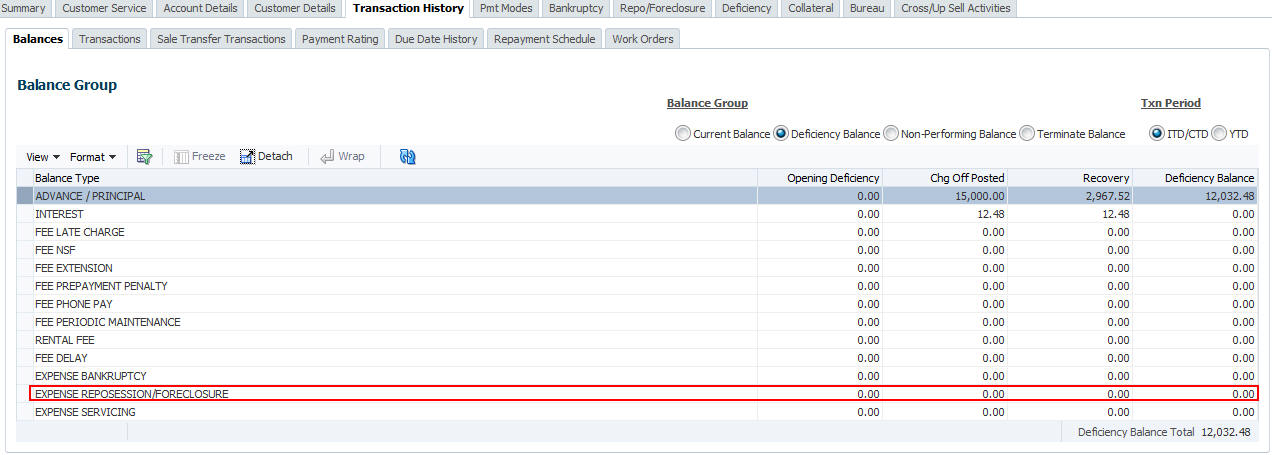

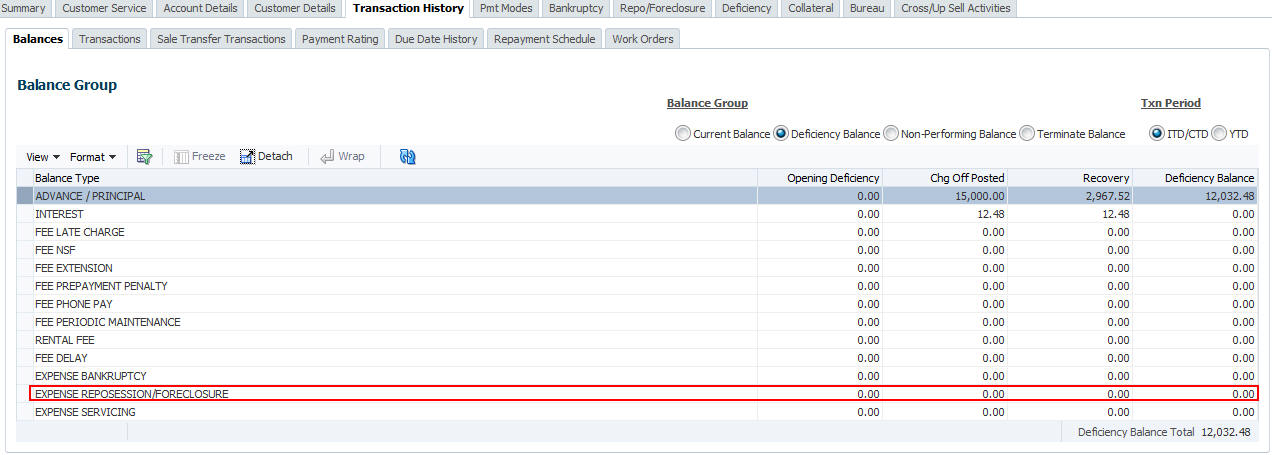

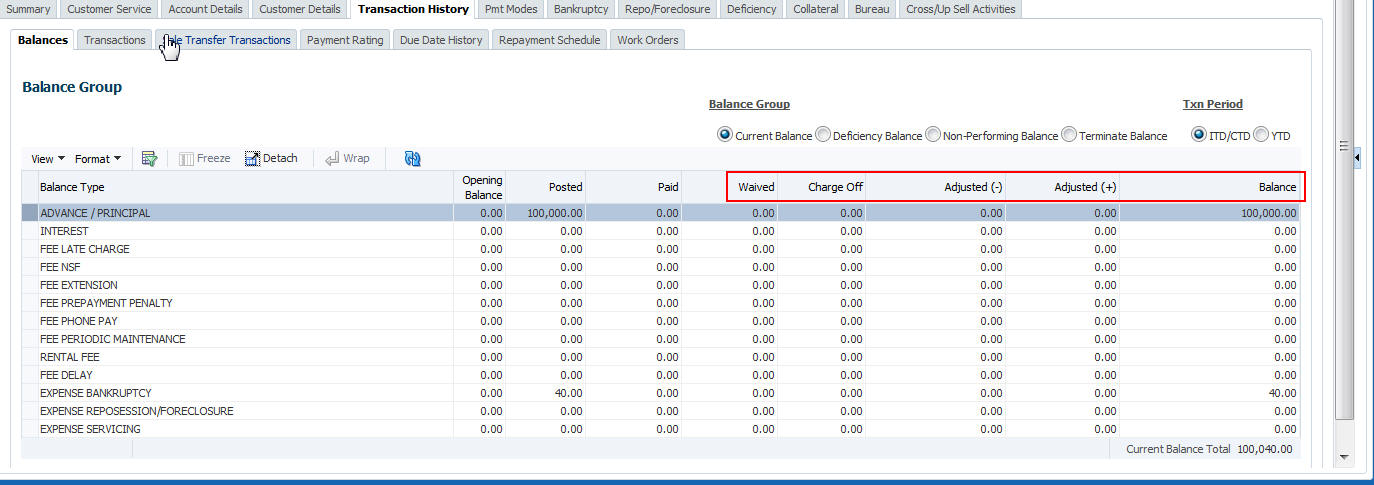

The adjustments will also appear in the corresponding column of Customer Service screen’s Account Balances screen for expense repossession/foreclosure Balance Type-- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To post a repossession expense

Transaction |

Parameters |

Repossession Expenses |

Txn Date Amount |

To adjust a repossession expense

Transaction |

Parameters |

Adjustment To Repossession Expenses - Add |

Txn Date Amount |

Adjustment To Repossession Expenses - Subtract |

Txn Date Amount |

To waive a repossession expense

Transaction |

Parameters |

Waive Repossession Expenses |

Txn Date Amount |

A.1.4 Bankruptcy Expenses

Bankruptcy expenses include any costs incurred when an account holder declares bankruptcy, such as legal fees or additional collection costs.

Bankruptcy expenses appear in the Other Due field on the Dues section of Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

The adjustments will also appear in the corresponding column of Customer Service screen’s Account Balances screen for expense bankruptcy Balance Type-- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To post a bankruptcy expense

Transaction |

Parameters |

Legal Bankruptcy Expenses |

Txn Date Amount |

To adjust a bankruptcy expense

Transaction |

Parameters |

Adjustment To Bankruptcy Expenses - Add |

Txn Date Amount |

Adjustment To Bankruptcy Expenses - Subtract |

Txn Date Amount |

To waive a bankruptcy expense

Transaction |

Parameters |

Waive legal Bankruptcy Expenses |

Txn Date Amount |

A.1.5 Phone Pay Fees

Phone pay fees are where a borrower calls the lender and arranges for a debit to their checking or savings account to make a payment on a Line of credit account.

Phone pay fees appear in Other Due field on Dues section of the Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a phone pay fee

Transaction |

Parameters |

Adjustment to Phone Pay Fee - Add |

Txn Date Amount |

Adjustment to Phone Pay Fee - Subtract |

Txn Date Amount |

To waive a phone pay fee

Transaction |

Parameters |

Waive Phone Pay Fee |

Txn Date Amount |

A.1.6 Financed Insurances

In this section, you can do the following:

A.1.6.1 Insurance Addition

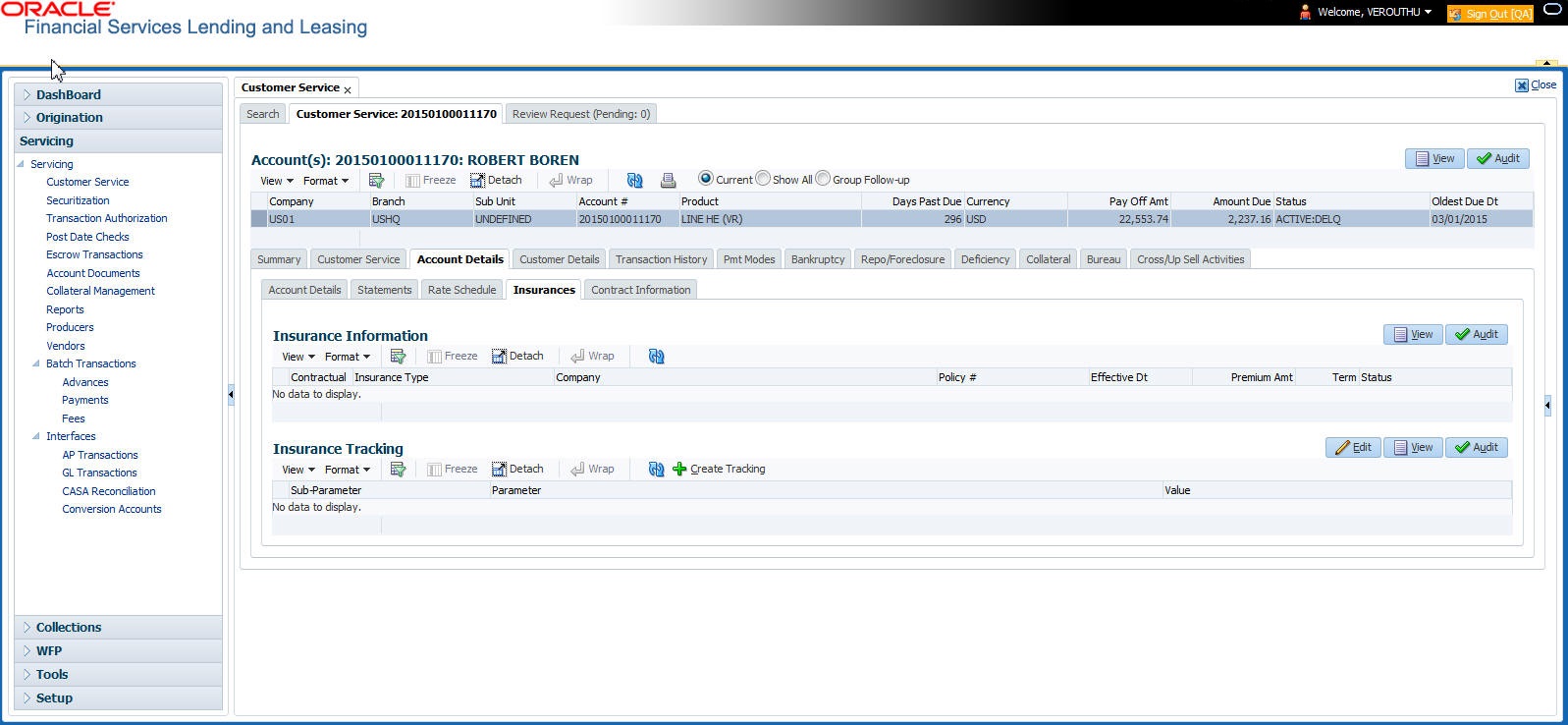

You can add financed insurance to an existing account with the INSURANCE ADDITION transaction. This transaction adds insurance premium amount to advance/principal balance on the Line of credit and adjusts the Line of credit receivables accordingly. The transaction also triggers the process to re-compute repayment amount for Line of credit. After you post the transaction Line of credit will be billed for newly computed payment amount and will be considered for delinquencies and fees calculations based on information on the Contract link’s Contract screen. The newly added insurance information can be viewed on Customer Service drop-down link’s Insurances link.

To add financed insurance

Transaction |

Parameters |

Insurance addition |

Txn Date |

Insurance Type |

|

Single/Joint |

|

Insurance Mode |

|

Insurance Plan |

|

Company Name |

|

Phone #1 |

|

Extn #1 |

|

Phone #2 |

|

Extn #2 |

|

Policy # |

|

Policy Effective Date |

|

Premium Amount |

|

Expiration Date |

|

Primary Beneficiary |

|

Secondary Beneficiary |

|

Comment |

A.1.6.2 Insurance Cancellation

You can cancel financed insurance on an existing account with the INSURANCE CANCELLATION transaction. When you post this transaction, the system computes premium refund amount based on the refund method associated with insurance item.

To cancel a financed insurance

Transaction |

Parameters |

Insurance Cancellation |

Txn Date |

Insurance Type |

|

Policy Effective Date |

|

Insurance Refund Amount |

|

Cancellation Reason |

|

Current Usage |

If you enter a value for INSURANCE REFUND AMOUNT parameter, the system overrides calculated refund amount and adjusts advance/principal balance and Line of credit receivables accordingly. The INSURANCE CANCELLATION transaction re-computes the repayment amount for Line of credit based on remaining balances. After posting the transaction, Line of credit will be billed for newly computed payment amount according information on the Contract tab’s Contract sub tab. The insurance cancellation information can be viewed on the Contract link’s Insurances sub screen.

Also if you enter a value for ‘Current Usage’, system computes the rebate amount using the 'Pro Rata (Mileage) method. However system also calculates the rebate amount using ‘Refund Calculation Method' and considers the minimum value out of both.

A.1.6.3 Insurance Modification

You may rectify possible errors resulting from incorrect information entered on the INSURANCE ADDITION transaction (such as an incorrect premium account) with the monetary transaction INSURANCE MODIFICATION.

When you post the INSURANCE MODIFICATION transaction, Oracle Financial Services Lending and Leasing re-computes the repayment amount using new premium amount and adjusts advance/principal balance on Line of credit and Line of credit receivables.

To modify financed insurance information

Transaction |

Parameters |

Insurance Modifications |

Txn Date |

Insurance Type |

|

Policy Effective Date |

|

Premium Amount |

A.1.7 Index/Margin Rates

You can change the current Index Rate type (i.e. Prime Rate or Flat Rate) and increase or decrease or even replace the current Margin Rate of a variable rate Line of credit up to the required basis points using the INDEX / MARGIN RATE CHANGE monetary transaction.

To change an index/margin rate

Transaction |

Parameters |

INDEX / MARGIN RATE CHANGE |

TXN DATE - Select the date from adjoining calendar. |

INDEX - Select from the drop-down list as either Prime Rate or Flat Rate. |

|

MARGIN RATE - Specify the Margin Rate. |

|

REASON - Specify additional information (if any). |

|

TXNS ADJUSTMENT TYPE - Select one of the following transaction adjustment type from the drop-down list: ACTUAL - Select this option to replace the existing Margin Rate with the current specified Margin Rate. INCREASE - Select this option to add the current specified Margin Rate to the existing Margin Rate. DECREASE - Select this option to reduce the current specified Margin Rate from the existing Margin Rate. However, note that reduction is permitted only up to existing Margin Rate and system displays an error if the current specified Margin Rate is greater than the existing Margin Rate. |

|

AUTO POST CHANGE PAYMENT - Select either YES or NO from the drop-down list. If there is a change in Margin Rate and this option is selected as YES, then system automatically posts CHANGE PAYMENT AMOUNT transaction along with RATE CHANGE transactions on the account. Behaviour of the CHANGE PAYMENT transaction follows the RATE CHANGE batch job behaviour. If there is a change in Margin Rate and this option is selected as NO, then system posts only RATE CHANGE transactions on the account. However note that this indicator is applicable to accounts funded with products of type 'Interest Bearing Loans' and Reschedule Method as 'Change Payment’. |

On clicking ‘Post’ system posts RESCHEDULE_INDEX monetary transaction to change the Index and Margin Rates. However, note that the ‘Auto Post Change Payment’ transaction changes the payment amount ‘only if’ the new calculated amount is greater than the old value.

A.1.8 Payoff Quotes

A payoff quote is the amount still owed on account or amount needed to satisfy the Line of credit. It can be generated anytime and may be requested during a call from a customer, dealer, or insurance agent. A payoff quote can either be generated for current or future date, but not on a back date.

The transaction processing details and new balances after posting payoff quote appears in Results section of Maintenance screen.

To generate a payoff quote for an account Line of credit

Transaction |

Parameters |

PAYOFF QUOTE |

TXN DATE |

PAYOFF QUOTE VALID UPTO DATE |

|

ASSESS PAYOFF QUOTE FEE |

|

PAYOFF QUOTE LTR PRINT |

|

COMMENT |

A.1.9 Account Paidoff

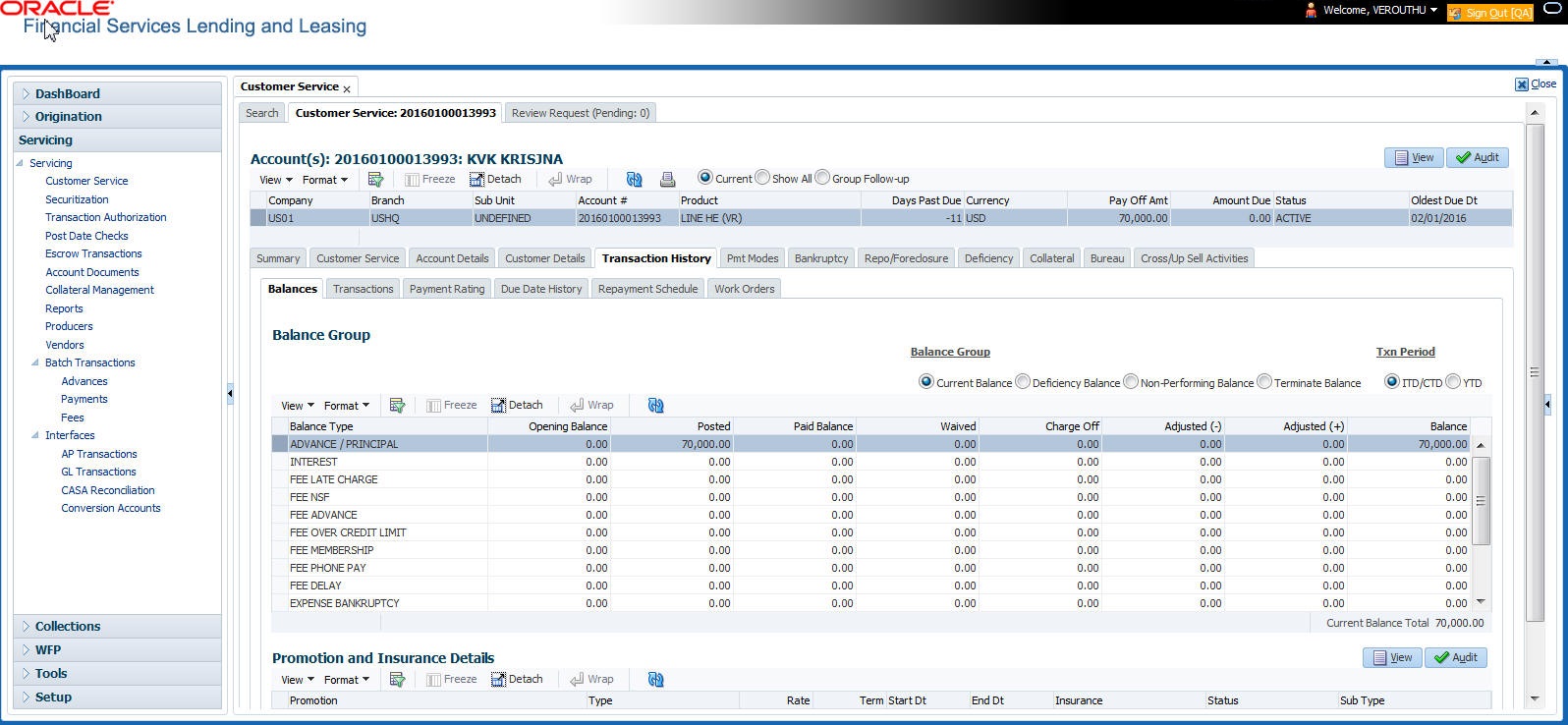

An account is automatically paid off or marked for payoff processing by the system with a batch transaction when the account balance is $0.00. You can also manually payoff an account with the Maintenance screen. You can also pay off an account using the Consumer Lending (Advance and Payment) form. For more information, see the Payment Processing chapter.

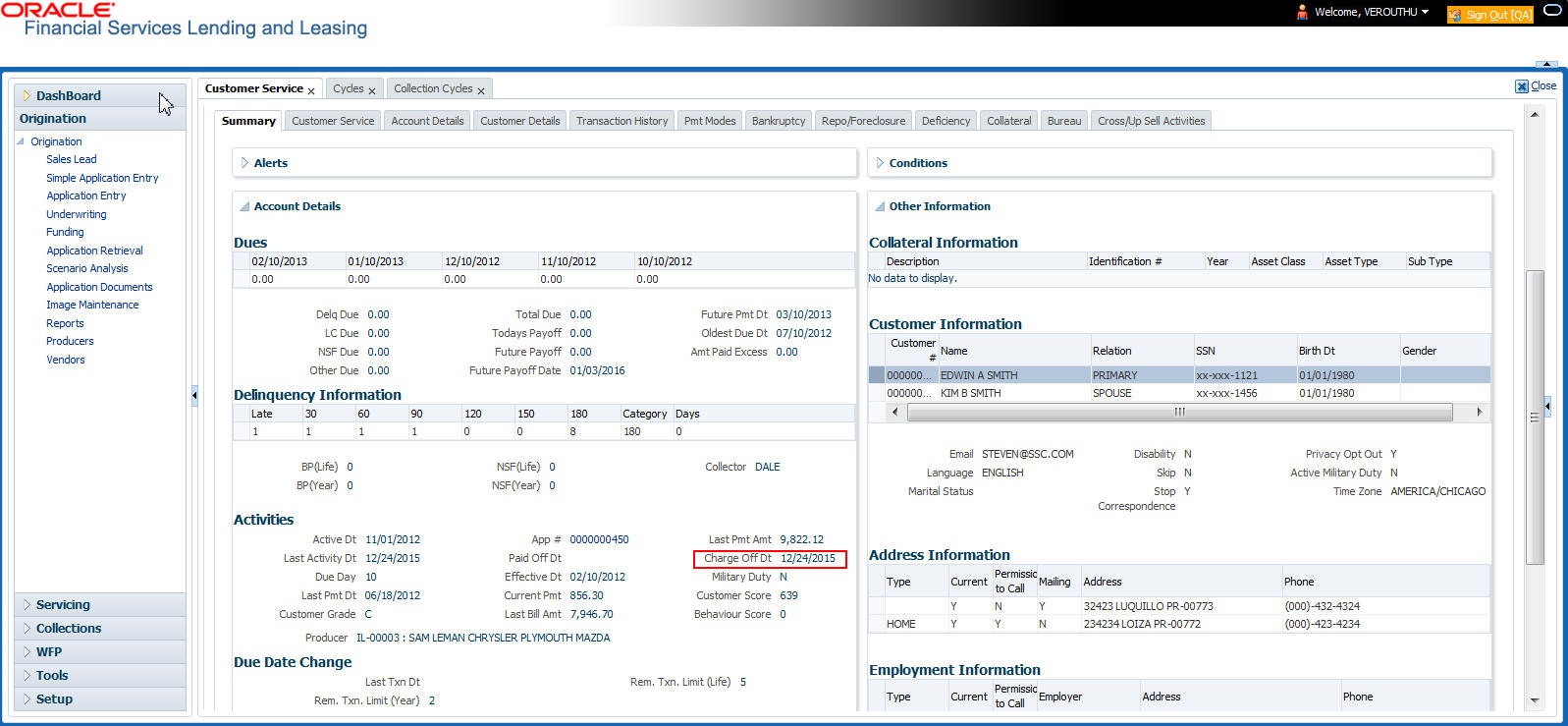

When you payoff an account, the system changes the account’s status to PAID OFF. The date the account was paid off appears in Activities section’s Paid Off Dt field on Account Details screen.

The system also notes the amount of the principal that was waived when account was paid off in the Waived column on Account Balances screen.

To pay off an account

Transaction |

Parameters |

Paid off |

Txn Date |

If you reverse the payoff payment using Customer Service form, then the pay-off is automatically reversed. The system changes the account’s status from PAID OFF to ACTIVE when you refresh the account.

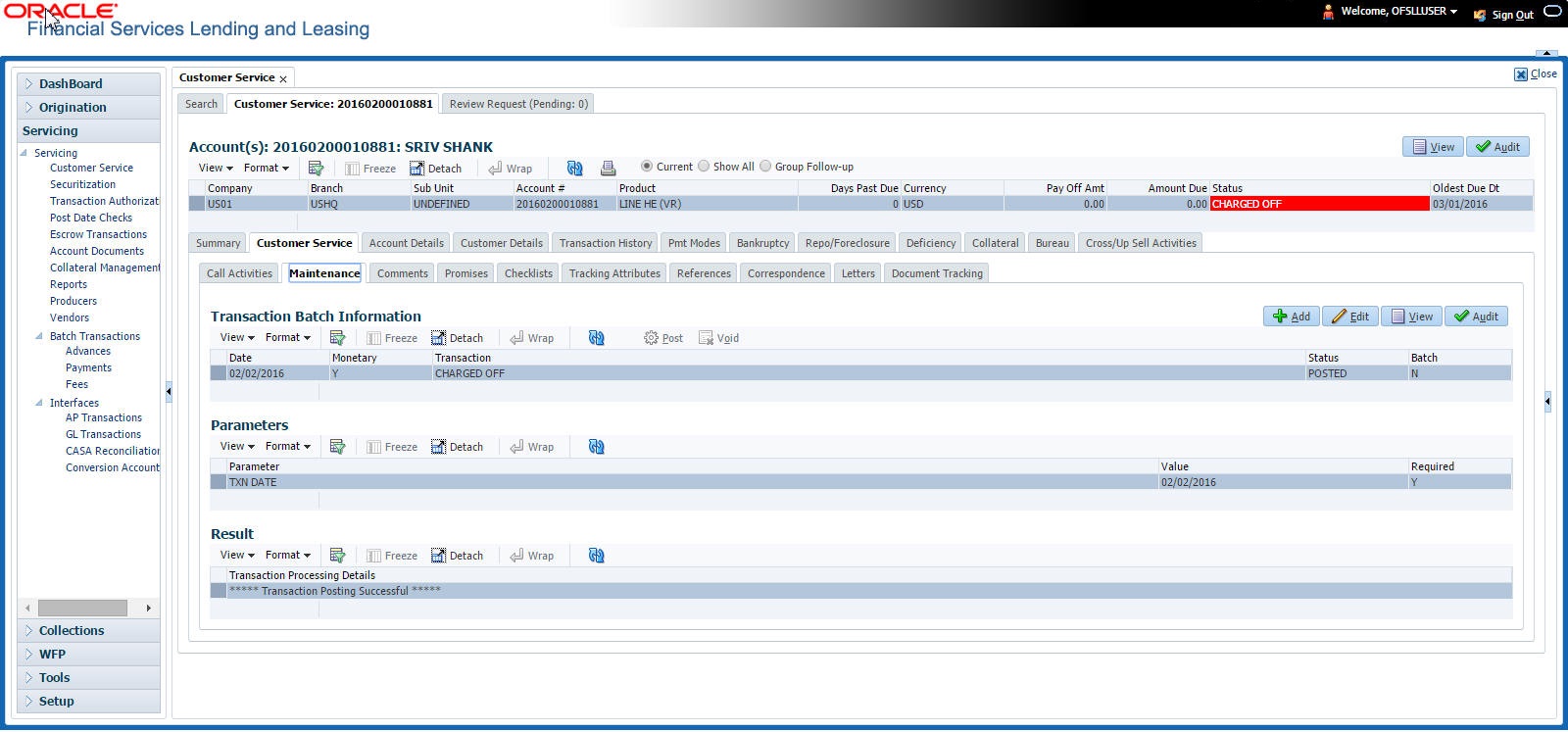

A.1.10 Account Charge Off

Charging off an account refers to when a lender decides to take a loss on an account, signalling that attempts to recover the Line of credit have failed. In calculating a charge off, the system considers the total compensation amount (up front compensation plus remaining compensation amount). It is different from the waive off process since a waive off is a concession offered to the customer on payment of some component, such as a late fee. The repayment of the original Line of credit still continues in waive off process.

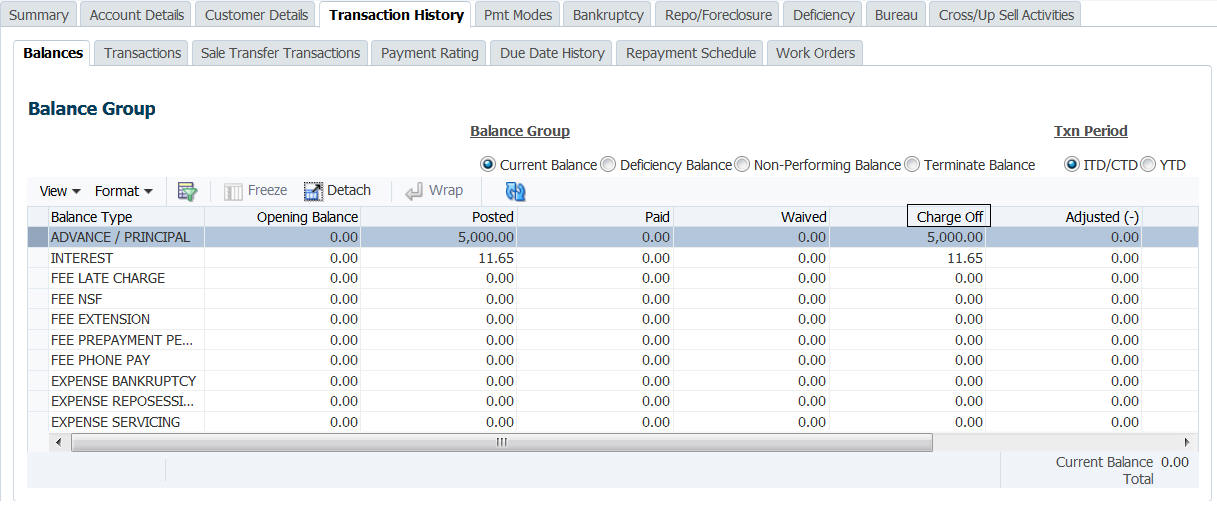

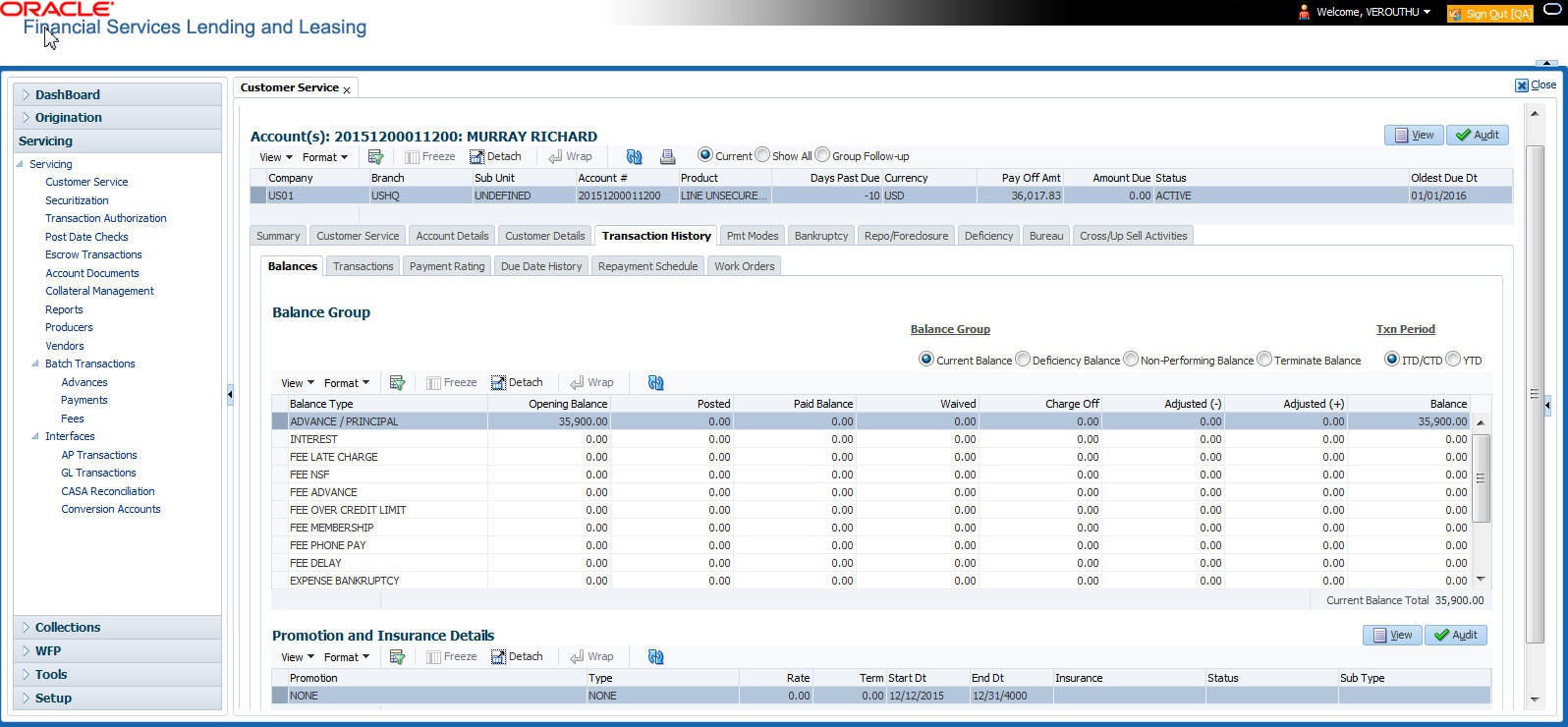

When you charge off account, the system changes the status to CHARGED OFF. The balance on the account appears on Customer Service form’s Balance screen when you choose Deficiency Balance in the Balance Group section.

The date of the charge off appears on Account Details screen in Activity section’s Chargeoff Dt field.

However, you can select the ‘Do Not Auto Charge Off’ condition to ignore few account conditions, for the charge-off processing batch job. When an account is marked with the condition DO NOT CHARGE OFF, then batch job will not pick the account for charge off processing.

You can add ‘Do Not Auto Charge Off’ condition in addition to the already existing condition.

You can post CHARGED OFF transaction on the entire hierarchy of Associated/Linked Accounts along with the Master Account i.e. if CHARGED OFF is initiated from an Associated/Linked account, system can post CHARGED OFF on all ACTIVE associated/linked accounts in the hierarchy along with the Master Account.

However, note that you can post CHARGED OFF on Master Account only if Associated Accounts are in TRADED, VOID, TERMINATE, PAID, and CHGOFF status.

To charge off an account

Transaction |

Parameters |

Charged Off |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS |

|

PROCESS MASTER ASSOCIATED ACCOUNTS |

|

PROCESS ALL ACCOUNTS BASED ON THE SALES ORDER NUMBER |

|

PROCESS LINKED ACCOUNT |

While posting the transaction,

- If PROCESS MASTER ACCOUNT is selected as ‘YES’, then CHARGE OFF transaction is automatically posted to corresponding Master Account. If selected as ‘No’, then CHARGE OFF transaction is posted to current account and its Linked account.

- If Master Account has multiple Linked and Associated Accounts with status TRADED, VOID and Account Close Indicator =N, then system displays an error indicating ‘Invalid status for Associated Accounts’.

- If PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS is selected as ‘Yes’, then CHARGE OFF transaction is automatically posted to accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. However, this parameter has no relevance if the 'Process to Master Account' is not set to 'Y'.

- If PROCESS MASTER ASSOCIATED ACCOUNTS is selected as 'Yes', then CHARGE OFF transaction is automatically posted to all Associated Accounts under the Master Account and selecting 'No' posts extension only to current account.

- If PROCESS ALL ACCOUNTS BASED ON THE SALES ORDER NUMBER is selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’.

- If PROCESS LINKED ACCOUNT is selected as ‘YES’, then CHARGE OFF transaction is automatically posted to current account and its Linked Account(s).

Note that during reversal of a CHARGED OFF transaction on hierarchy of Associated/Linked Accounts, ensure that Master Account is in ACTIVE status. Else, system restricts posting Reversal of a CHARGED OFF transaction for an Associated Account and displays an error indicating ‘CHARGED OFF cannot be reversed - Master Account must be in ACTIVE status’.

A.1.11 Account Closure

The system automatically closes an account when its status changes from ACTIVE status to Paid or Void. It is manually closed if it has status as CHARGE OFF. Accounts marked as Closed are not processed and after a period of time are purged from Oracle Financial Services Lending and Leasing.

To close an account

Transaction |

Parameters |

Account Close |

Index Txn Date |

A.1.12 Advance (Principal) Balance

The advance (or principal) balance is posted automatically when you fund the contract on Funding screen. You are not allowed to post the advance with Customer Service screen. However, you can waive, charge off or adjust the advance or principal.

The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances sub tab for ADVANCE / PRINCIPAL Balance Type -- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust the advance/principal balance

Transaction |

Parameters |

Adjustment To Advance/Principal - Add |

Txn Date Amount |

Adjustment To Advance/Principal - Subtract |

Txn Date Amount |

To charge off the advance/principal balance

Transaction |

Parameters |

Chgoff Advance/Principal |

Txn Date Amount |

To waive the advance/principal balance

Transaction |

Parameters |

Waive Advance/Principal |

Txn Date Amount |

A.1.13 Interest

The interest is accrued or posted automatically when you post the payment on Advance screen’s Advance Entry tab. You cannot post the interest in the Customer Service screen; however, you can adjust or waive interest.

The adjustments will appears in the corresponding column of Customer Service form’s Account Balances screen for INTEREST Balance Type-- Waived, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust the interest

Transaction |

Parameters |

Adjustment To Interest - Add |

Txn Date Amount |

Adjustment To Interest - Subtract |

Txn Date Amount |

To waive the interest

Transaction |

Parameters |

Waive Interest |

Txn Date Amount |

A.1.14 Interest Accrual

You can start or stop interest accrual on a Line of credit.

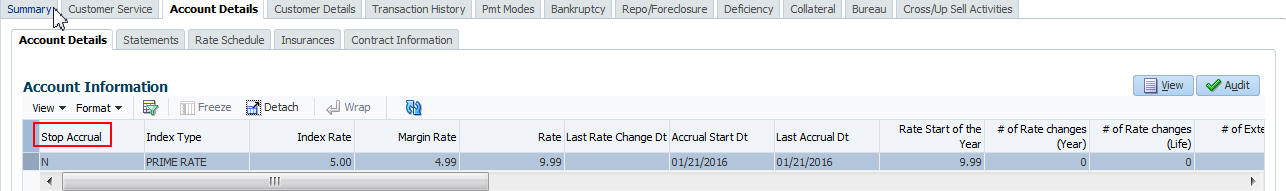

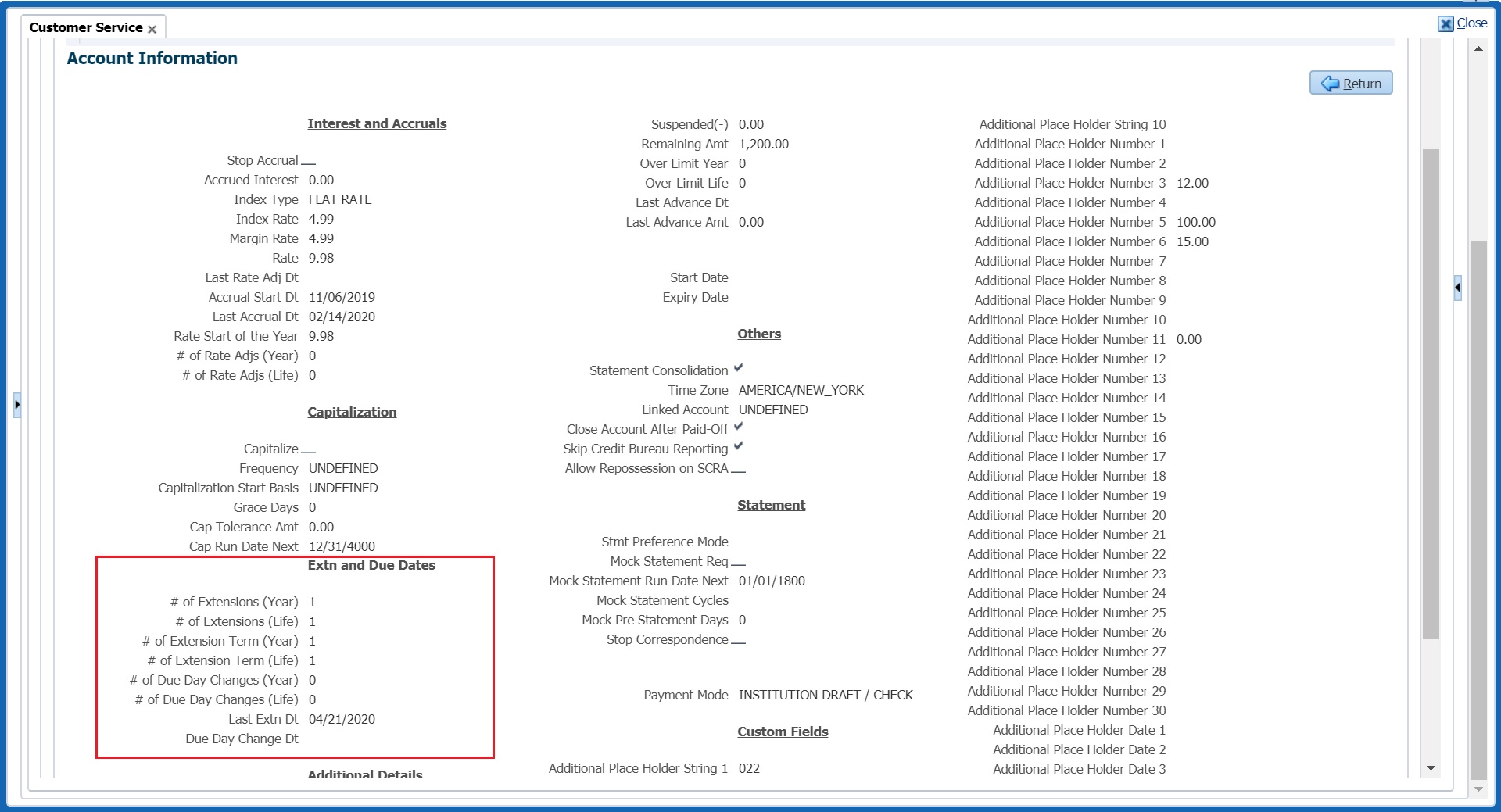

On the Line of credit Details screens, Stop Accrual box is selected in Interest and Accruals section.

To remove Stop Accrual indicator, post the start ACCURAL transaction.

To start interest accrual for an account

Transaction |

Parameters |

Start Accrual |

Txn Date |

To stop interest accrual for an account

Transaction |

Parameters |

Stop Accrual |

Txn Date |

A.1.15 Active Military Duty

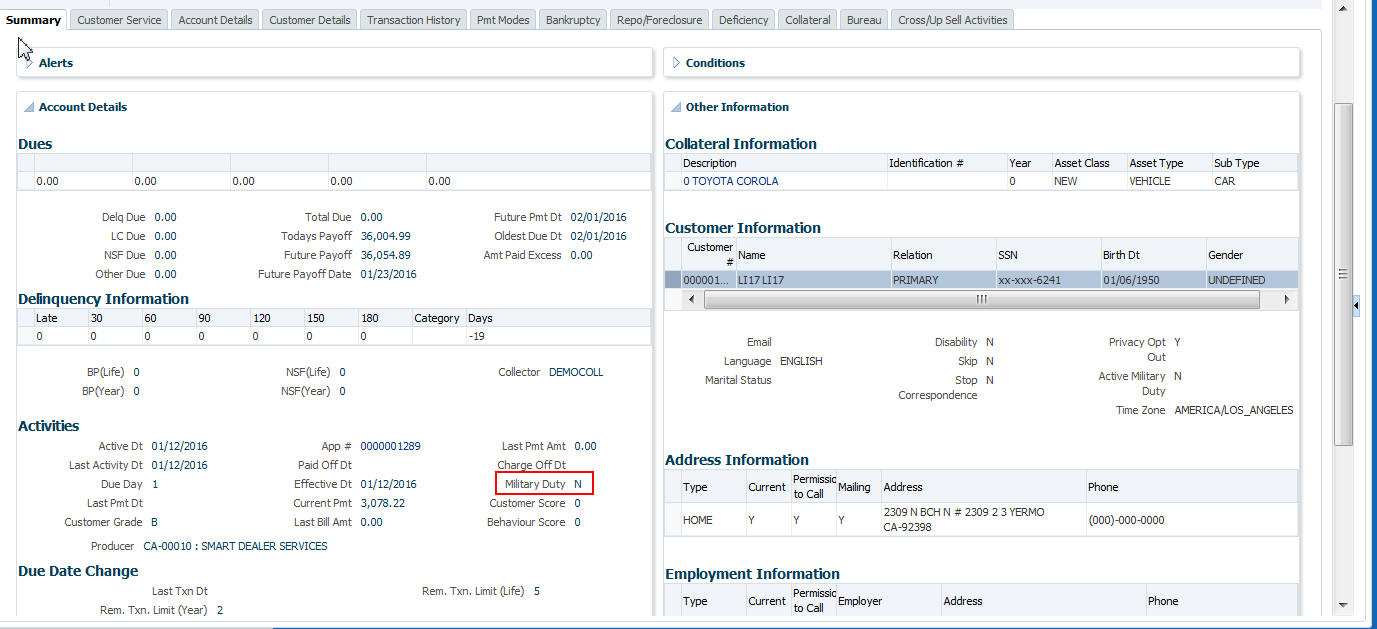

The Servicemembers Civil Relief Act of 2003 (SCRA), formerly known as the Soldiers and Sailors Civil Relief Act of 1940 (SSCRA), is a federal law that gives military members some important rights as they enter active duty military service. The law is designed for active duty military personnel and reservists (and their spouse -- if applicable for joint credit accounts) to receive, as a result of military service economic hardship(s), an interest rate reduction (currently at 6.000%) for certain consumer and mortgage-related debt that was incurred prior to entering military service, for the period of time that the servicemember is on active duty. Under the law, the term’s interest includes service charges, renewal charges, fees, or any other charges (except bona fide insurance) with respect to an obligation or liability. The law also provides protection against certain legal actions during the term of active duty military service. The SCRA function is currently available in the system for simple interest LoanLine of credit.

Any account that has been identified under SCRA requirements as eligible for the allowable benefits of active military duty for its primary borrower/spouse will have a new interest rate calculation based upon the 6.000% limit set by the SCRA. However, this change is subject to exception in case of accounts that already have an interest rate less than 6.000%. In such cases, the original interest rate that is less than 6.000% will continue.

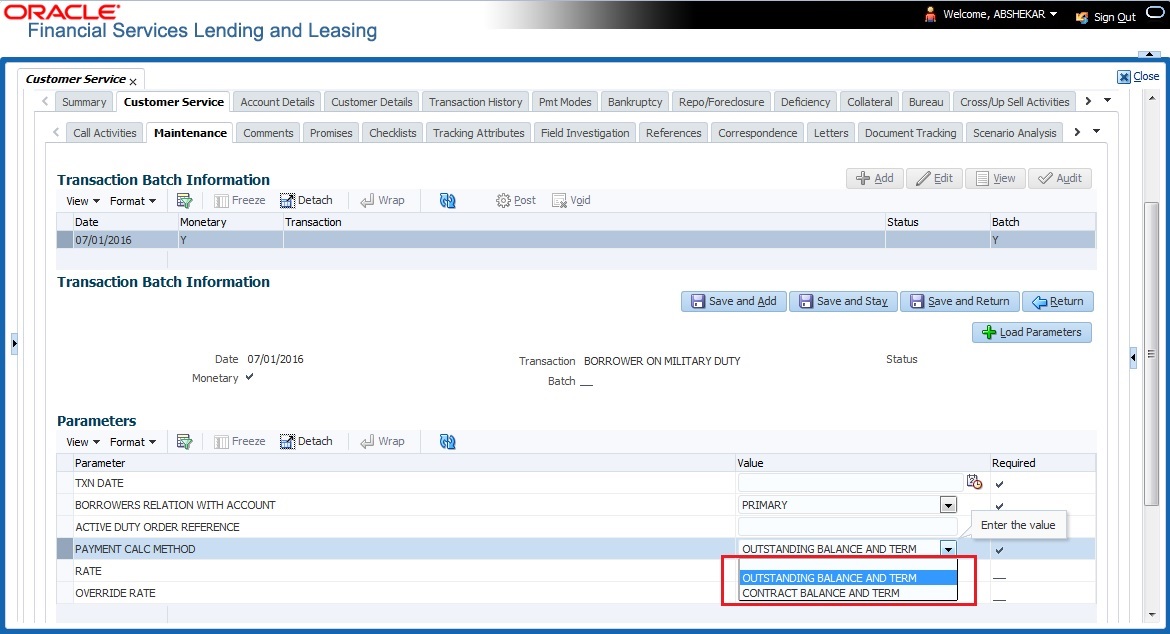

To indicate that a borrower is on active military duty

Transaction |

Parameters |

Borrower On Military Duty |

Txn Date |

Borrowers Relation With Account |

|

Active Duty Order Reference |

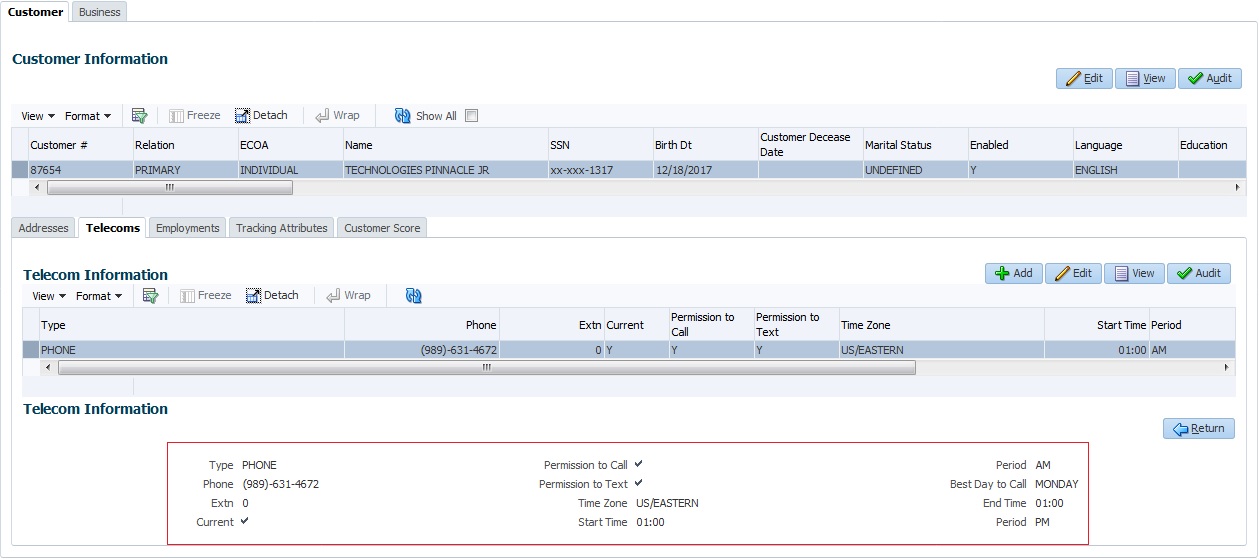

After you post this transaction, the Military Duty box (Account Details screen Activities section) and Active Military Duty box (Customer Details screen Military Service section) are selected. Oracle Financial Services Lending and Leasing changes the condition of the account to ON ACTIVE DUTY. Details of the transaction appear in the Military Services section on Customer Details screen.

If the interest rate was greater than 6%, Oracle Financial Services Lending and Leasing will change the rate to 6% and adjust the payment accordingly. The CHANGE PAYMENT AMOUNT and RATE CHANGE transactions on the Transactions screen.

While posting an SCRA transaction for a borrower who is on 'Active Military Duty', system processes a lower payment amount regardless of prior payment history.

To indicate the payment parameters when the borrower is on active military duty

Parameter Name - CUST_ON_MLTRY_DUTY

Transaction |

Parameters |

Borrower On Military Duty |

Txn Date |

Borrowers Relation With Account |

|

Active Duty Order Reference |

|

Payment Calculation Method |

|

Rate |

|

Override Rate |

The Payment Calculation Method has the following options in drop-down list for selection:

- Outstanding Balance & Term - System calculates the new payment amount using Outstanding Principal, SCRA Rate, Remaining Term.

- Contract Balance & Term - System calculates the new payment amount using Contract principal, SCRA Rate, Contract Term.

Note

If the borrower is delinquent during the life of loan, any outstanding balance would be paid along with last installment amount.

OFF-Military Duty

If the borrower is off-military duty, the transaction ‘BORROWER OFF MILITARY DUTY’ is posted to restores the interest and instalment amount for the remaining term of the loan.

To indicate that a borrower is no longer on active military duty

Transaction |

Parameters |

BORROWER OFF MILITARY DUTY |

TXN DATE |

BORROWERS RELATION WITH ACCOUNT |

|

SCRA OFF PAYMENT CALC METHOD |

To adjust the contracted interest rate and Payment Amount, the SCRA off Payment Calculation Method has the following options in drop-down list for selection:

- Restore Account Payment - System restores contract interest rate and instalment amount.

- Remaining balance (if any) after ‘Restore to Account Payment’ is adjusted to the last instalment amount as a balloon payment.

- In case if a ‘Rate Change’ transaction is posted on account before posting ‘On Military Duty’ transaction, system calculates the remaining payment amount as per the changed interest rate and not the contract rate.

- Calculate New Payment - System recalculates the payment amount using contract interest rate.

After you post this transaction, the Military Duty box (Account Details screen Activities section) and Active Military Duty box (Customer Details screen Military Service section) are de-selected. Oracle Financial Services Lending and Leasing changes the condition of the account to OFF ACTIVE DUTY.

A.1.16 Due Date Change

You can change the due date of an account. When it is changed, the system determines next bill date, as well as the next due date. The DUE DATE CHANGE transaction does not allow next billing date to change such that it is less than the current billing date. The due date change transaction has been extended to change the default ACH due day, provided that the account due day and ACH due day match.

If a late fee is no longer applicable because of this due day change, Oracle Financial Services Lending and Leasing will automatically remove the fee.

The new due day appears in Activities section Due Day field on the Account Details screen.

The system also notes change on Line of credit Details screens in Extn and Due Dates section’s # of Due Day Changes (Year), # of Due Day Changes (Life) and Due Day Chg Dt fields.

To change a due date

Transaction |

Parameters |

Due Date Change |

Txn Date |

Due day |

|

Due Date |

|

ACH DUE DATE CHANGE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts and selecting ‘No’ on master account displays an error and rolls-backs all the changes. Note: System does not allow to post the transaction if this parameter is selected as NO and the Statement Consolidation option at account level is set to ‘Y’. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

|

PROCESS SAME SALES ORDER NBR ACCOUNTS If selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’. |

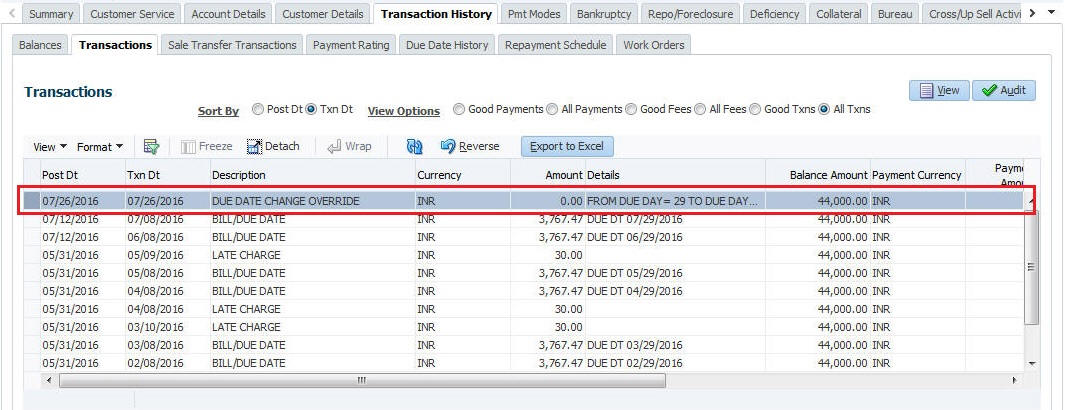

A.1.16.1 Override Due Date Change

You can override the contract ‘Due Date’ of an account to mark-up the due days limit to the required standard business rules by posting the following monetary transaction.

To override a due date change

Transaction |

Parameters |

DUE DATE CHANGE OVERRIDE |

TXN DATE |

DUE DAY |

|

DUE DATE |

|

ACH DUE DATE CHANGE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts and selecting ‘No’ on master account displays an error and rolls-backs all the changes. Note: System does not allow to post the transaction if this parameter is selected as NO and the Statement Consolidation option at account level is set to ‘Y’. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

|

PROCESS SAME SALES ORDER NBR ACCOUNTS If selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’. |

On posting the transaction system ignores the following Due Day contract parameters:

- Max Due Day Change/Yr

- Max Due Day Change/Life

- Max Due Day Change Days

- Due Day Min

- Due Day Max

On successful posting of the transaction, system automatically increases the number on counters (i.e. number of times due date change permitted) for ‘Max Due Day Change/Yr’ and ‘Max Due Day Change/Life’. The transaction is displayed in Customer Service > Transaction History > Transactions screen.

A.1.16.2 Reverse an Override Due Date Change

When a posted ‘Due Date Change Override’ transaction contains error or non desired results, you can reverse the same in Customer Service > Transaction History > Transactions screen.

Select the Due Date Change Override transaction and click Reverse.

On successful posting of the transaction, system reverts (decreases) the change in the number on counters (i.e. number of times due date change permitted) for ‘Max Due Day Change/Yr’ and ‘Max Due Day Change/Life’.

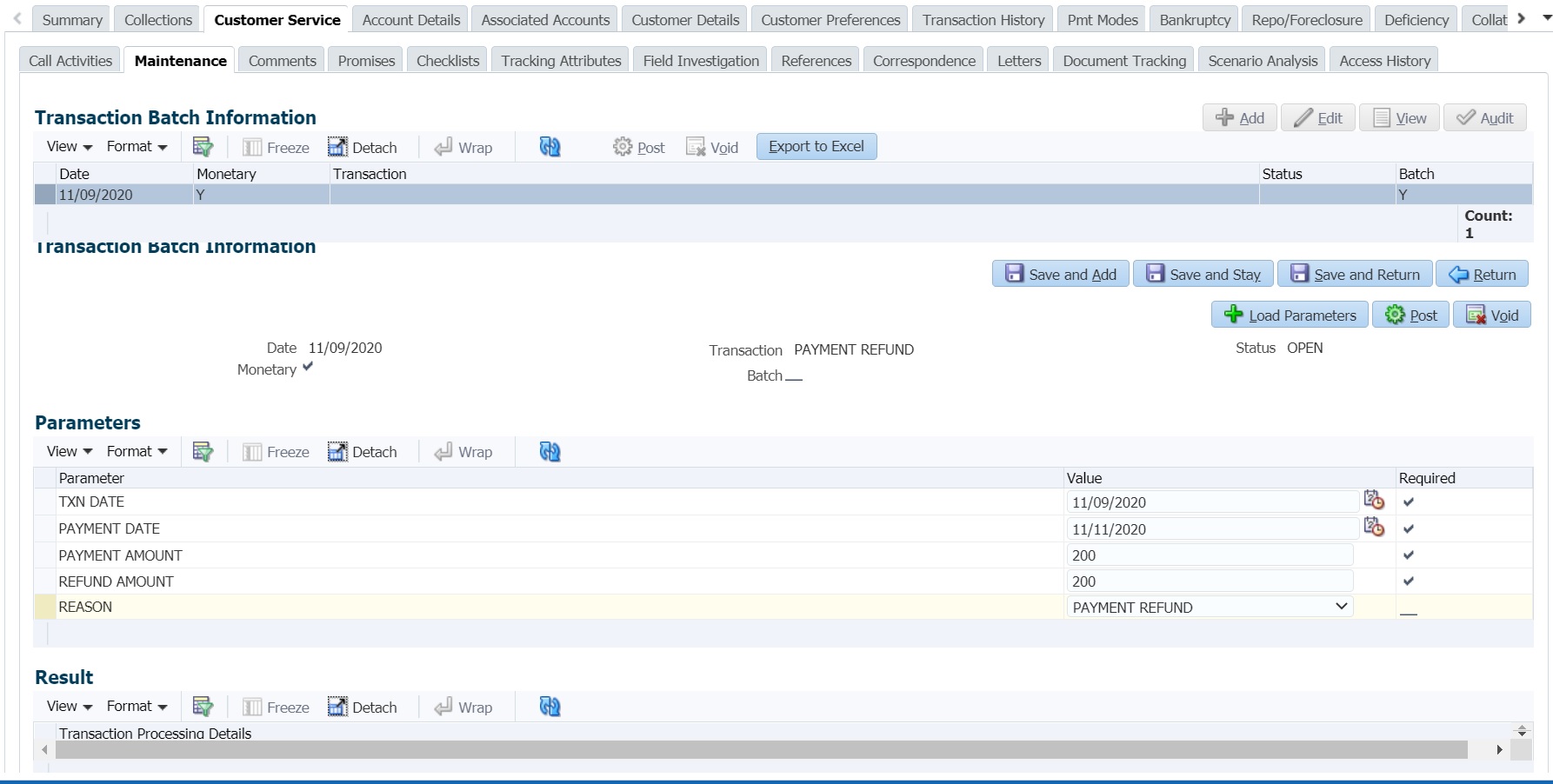

A.1.17 Payment Refund Transaction

Payment refund transactions allows you to refund excess payment received from the customer during life of the Line of credit. The Payment Refund transaction is posted at the maintenance screen in servicing. The refund is posted only when the refund amount is equal to Payment amount. Else an error message is displayed.

To refund the payment amount

Transaction |

Parameters |

PAYMENT REFUND (PMT_RF) |

TXN DATE Select the transaction date from adjoining calendar. |

PAYMENT DATE Select the payment posted date from adjoining calendar. |

|

PAYMENT AMOUNT Specify the payment amount received on the account. |

|

REFUND AMOUNT Specify the payment amount to be refunded. |

|

REASON Select the appropriate reason code from the drop-down list. The list is populated based on the lookup code TXN_REASON_CD (SUB CODE USED FOR REASON GROUP). |

Note that except ‘Reason’ all the other parameters are mandatory for posting payment refund transaction. However, system validates for appropriate reason code when auto-posted from Payment Maintenance screen.

On successfully posting the transaction, the payment refund details are recorded in Customer Service > Transaction History > Transactions tab.

A.1.18 Extensions

Extension transactions allow you to extend a Line of credit by moving the balances to future date. Extensions can either be based on ‘Unpaid’ due date or on Oldest due date. An extension fee may be assessed when an account receives an extension.

The system adjusts due date on Dues section’s Oldest Due Dt field on Account Details screen to reflect the extension.

It also notes the change with an entry on the Line of credit Details screen in the Extn and Due Dates section’s # of Extensions (Year), # of Extensions (Life), # of Extension Term (Year) # of Extension Term (Life) fields.

To apply an extension

Transaction |

Parameters |

EXTENSION |

TXN DATE Select the extension transaction date from adjoining calendar. |

EXTENSION TERM Specify the required extension term in months. |

|

REASON Select the reason for extension from the drop-down list. |

|

STOP ACCRUAL Select either YES or NO from drop-down list to stop the interest accrual on the account. |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the extension transaction to Master Account and Associated Accounts and selecting ‘No’ posts extension only to current account. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

EXTENSION BASIS Select one of the following option as the basis for posting the extension from the drop-down list. OLDEST DUE DATE -To post extension considering the oldest unpaid due date. Any paid due buckets is not altered and original due dates are retained. UNPAID DUES - To post extension considering only the unpaid due buckets. Here the unpaid due dates are moved by adding the terms represented in the transaction. Unpaid dues are those for which Payment = N in Due Date History and may also include the partially paid amount (i.e. paid amount - tolerance amount). |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

|

PROCESS SAME SALES ORDER NBR ACCOUNTS If selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’. |

While posting an extension, ensure that the minimum number of required payments, as defined at contract level is met. Else, system displays an error message on verification. Also while posting subsequent extension transactions, ensure that the minimum gap requirement between two extensions is satisfied.

A.1.19 Prepayment Penalty

A prepayment penalty is typically applied automatically by Oracle Financial Services Lending and Leasing if the account is paid off prematurely.

The following transactions allow you to adjust or waive the prepayment penalty fee. The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances screen for fee prepayment penalty Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following the transactions you perform.

To adjust a prepayment penalty

Transaction |

Parameters |

Adjustment Prepayment Penalty - Add |

Txn Date Amount |

Adjustment Prepayment Penalty - Subtract |

Txn Date Amount |

To waive a prepayment penalty

Transaction |

Parameters |

Waive Prepayment Penalty |

Txn Date Amount |

A.1.20 Escrow Payment

The following monetary transactions allow you to specify escrow payment to be billed to the customer each month. Rescheduling an escrow payment enables you to change the payment rate (and hence rate and term) and define when change will begin. The “txn date” parameter is when the new agreement starts.

The following transactions allow you to adjust or waive the escrow advance.

The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances screen for escrow advance Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust escrow advance

Transaction |

Parameters |

Adjustment to escrow advance - add |

Txn Date Amount |

Adjustment to escrow advance - subtract |

Txn Date Amount |

To waive escrow advance

Transaction |

Parameters |

Waive Escrow Advance |

Txn Date Amount |

To reschedule an escrow payment

Transaction |

Parameters |

Reschedule Escrow Payment |

Txn Date Amount |

A.1.21 Escrow balance refund

If an account is paid off resulting in a positive (greater than $0) escrow balance or the last item being escrowed is removed resulting in a positive (greater than $0) escrow balance, then Oracle Financial Services Lending and Leasing refunds the escrow and creates a check requisition.

A.1.22 Pay Off Quote Fee

The PAYOFF QUOTE transaction on Maintenance screen includes the required parameter ASSESS PAYOFF QUOTE FEE. If you select Y, Oracle Financial Services Lending and Leasing assesses a payoff quote fee on Customer Service form’s Balances screen for Balance Type FEE PAYOFF QUOTE. The amount of the payoff quote fee is based on contract setup.

The following transactions allow you to adjust or waive the pay off quote fee.

The adjustments will appears in the corresponding column of Customer Service form’s Balances screen for FEE PAYOFF QUOTE Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust a pay off quote fee

Transaction |

Parameters |

Adjustment to Payoff Quote Fee - Add |

Txn Date Amount |

Adjustment to Payoff Quote Fee - Subtract |

Txn Date Amount |

To waive a pay off quote fee

Transaction |

Parameters |

Waive Payoff Quote Fee |

Txn Date Amount |

A.1.23 Nonperforming Accounts

Line of credit accounts can be placed in a nonperforming, or nonaccrual, condition. Once an account is set to a nonperforming condition, the system makes the following modifications and accounting entries:

- After the transaction date, Oracle Financial Services Lending and Leasing assesses no late charge to this account.

- Stops general ledger entries for interest accrual.

- Transfers the existing principal balance on this account to the Non-Performing Balance Group on Customer Service form’s Balance screen.

- Charges the unearned dealer compensation back to the dealer.

- Treats payments posted to this account as it does with a normal account; however, the general ledger entries for allocation of these amounts towards principal and interest will go towards the nonperforming balance.

The system’s general ledger (GL) is set up for the above items. There will be no impact on balances of the account (principal, interest, fee and expense) as a result of the above transactions.

To place an account in a nonperforming condition

Transaction |

Parameters |

Account Non Performing |

Txn Date |

Non Performing Description |

The following transaction removes nonperforming condition on an account and reverses the nonperforming transactions explained above. General ledger entries for interest accrual, stopped during nonaccrual stage, resume.

To reverse a nonperforming condition

Transaction |

Parameters |

Resume Account Performing |

Txn Date |

A.1.24 Convert a Precomputed (PC) Line of credit into a Simple Interest (SI) Line of credit

When converting a precomputed Line of credit into a simple interest Line of credit, Oracle Financial Services Lending and Leasing assumes the following default values:

- Accrual Calculation Method - interest bearing (simple interest)

- Maturity Date - Computed from the term and next payment due date

- Monthly Payment Amount - Computed from the interest rate, new principal balance, accrual start date, and term.

- All balances other than the Note balance are carried over to simple interest Line of credit.

The resulting ‘new’ simple interest Line of credit will have the same account number with details entered/computed above.

Caution: The converting a precomputed Line of credit into a simple interest Line of credit transaction can be performed only by closing the nonperforming condition.

To reschedule precomputed Line of credit to interest bearing Line of credit

Transaction |

Parameters |

Reschedule Pre-Compute Line of credit to Interest Bearing Line of credit |

Txn Date |

Reschedule Payment Start Date |

|

Amount |

|

Rate |

|

Term |

A.1.25 Trading of Accounts - Monetary Transactions

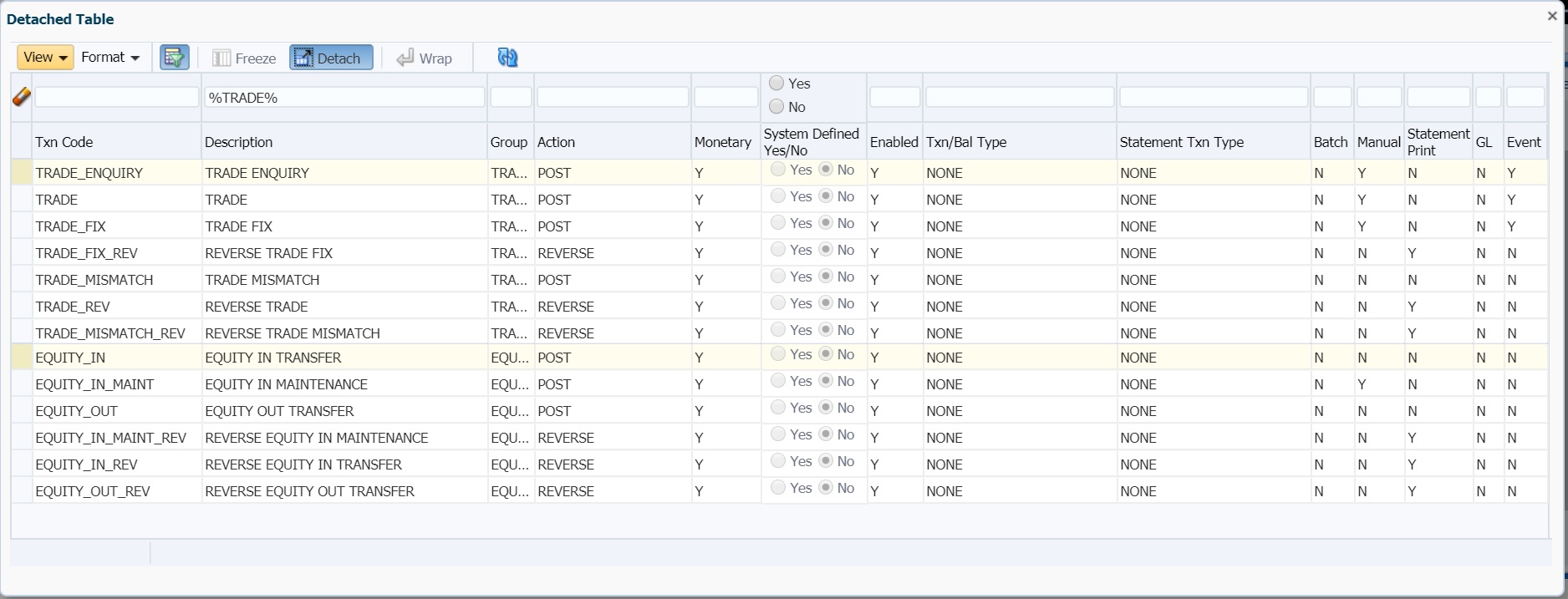

Following are the monetary transactions involved while processing Trading of Accounts. These processes are either posted automatically by external origination system or need to be posted manually in Servicing > Customer Service > Maintenance screen. For information about how Trading of Accounts is processed in OFSLL, refer to ‘Trading of Accounts’ chapter.

- Trade Enquiry Transaction

- Trade Transaction

- Equity Out Transfer Transaction

- Equity In Transfer Transaction

- Trade Fix Transaction

- Equity in Maintenance Transaction

- Account Charge Off

A.1.25.1 Trade Enquiry Transaction

Trade Enquiry monetary transaction is posted by external origination system to validate if an Account can be traded. This transaction provides details of total available Equity of an Account for a Specific Validation Date. However, the Trade Amount computation is configurable using User Defined Parameters defined in Setup > Administration > User Defined Parameters screen.

To post Trade Enquiry transaction

Transaction |

Parameters |

TRADE ENQUIRY |

TXN DATE |

TRADE ENQUIRY VALID UPTO DATE |

|

TRADE ENQUIRY LTR PRINT |

|

COMMENT |

While posting the transaction,

- If TRADE ENQUIRY VALID UPTO DATE is specified, then system calculates Accrued Interest on account till the date specified.

- If TRADE ENQUIRY LTR PRINT is selected as ‘YES’, then a Trade Enquiry Letter with specific format is generated. The value of parameters in the letter are fetched from variables defined in the configuration.

On posting this transaction, system displays the response based on configurable calculation parameter definition defined for ‘Trade Equity’ (ACC_EQUITY_AMT) in User Defined Parameters screen. Only those definitions with valid selection criteria are consider for processing.

On processing the transaction, the Result section displays the following information:

- A set of pre-defined details such as:

- ACCOUNT NUMBER

- MASTER ACCOUNT NUMBER (if associated)

- ACCOUNT CURRENCY

- System derived values from User Defined Parameters configuration > Formula Variables.

- System derived interest value if the definition contains Accrued Interest as Formula Variable which is calculated based on TRADE ENQUIRY VALID UPTO DATE as similar to payoff quote.

- System derived final composite Trade Equity value and displays based on the description provided for Target Parameter.

On successful posting the transaction, a comment is posted on the Account indicating ACCOUNT TRADE EQUITY PROVIDED TO FOR AMOUNT USD <AMOUNT> VALID UPTO <DATE>.

A.1.25.2 Trade Transaction

Trade monetary transaction is posted by external origination system to Trade and transfer equity from an existing (old) Account to new Account. This transaction implicitly posts Equity-In transfer and Equity-Out transfer transactions on new and old accounts respectively.

Following are the different types of Trade transactions supported:

Type |

Description |

Upgrade |

In this case, one existing (old) Account is upgraded to new Account. |

Split |

In this case, one existing (old) Account is upgraded to multiple new Accounts. |

Combine |

In this case, multiple old Accounts are upgraded to one new Account. |

To post Trade transaction

Transaction |

Parameters |

TRADE |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS LINKED ACCOUNT |

|

VALIDATE COMMON CUSTOMER |

|

COMMENT |

While posting the transaction,

- If PROCESS MASTER ACCOUNT is selected as ‘YES’, then Trade transaction is automatically posted to corresponding Master Account.

- If PROCESS LINKED ACCOUNT is selected as ‘YES’, then Trade transaction is automatically posted to corresponding Linked Accounts.

- If VALIDATE COMMON CUSTOMER is selected as ‘YES’, then system validates for a common customer between existing (old) and new account. If not, displays an error.

Note the following:

- Before processing actual trade transaction, Trade Equity is computed and updated in ACC_EQUITY_AMT.

- If Trade transaction is posted on Accounts where Trade Equity is zero, then system considers those as ‘Non-Equity Based’ accounts.

- As part of Trade process if Trade Eligible flag is set to ‘N’ for an Asset, then that particular Asset Status is marked as ‘ACTIVE’. Else, asset status is updated to INACTIVE.

Trade transaction will be posted ‘Only if’ the resultant value of following 3 are similar:

- Sum of Equity in itemization of new Accounts

- Sum of Trade Equity of existing (old) Accounts

- Sum of Equity Transfer Amount in Trade Details

In case of mismatch in any one of above, Trade transaction is not posted and instead TRADE MISMATCH transaction is automatically posted by the system with same transaction parameters on the existing (old) account along with a condition - EQUITY MISMATCH DURING TRADE.

In addition,

- During the Trade transaction, a linked ‘Equity Out Transfer Transaction’ is posted on existing (old) Account to transfer Equity to new account.

- Adjustment minus transaction is posted for all open balances on traded (old) Account to mark the outstanding amount as zero.

On successfully posting of Trade transaction,

- A Comment is posted on existing (old) account in the format ACCOUNT TRADED ON <DATE> WITH TOTAL TRADE EQUITY <VALUE> WITH <TRADE FIX REASON> AND <COMMENT>

- Account status is updated as TRADED.

A.1.25.3 Equity Out Transfer Transaction

‘Equity Out Transfer’ monetary transaction is automatically posted by the system to transfer Equity from existing (old) account to new account created as part of trade.

Equity Out transaction parameters

Transaction |

Parameters |

EQUITY OUT TRANSFER |

TXN DATE |

ACCOUNT NBR |

|

AMOUNT |

|

COMMENT |

|

TRADE TYPE |

On successfully posting the transaction, the ‘Equity Out’ field is updated in Account Details > Trade Details screen and a comment is posted on the existing (old) account in the format ACCOUNT EQUITY OUT TRANSFERRED ON <DATE> TO ACCOUNT NUMBER <ACCOUNT NUMBER> WITH VALUE <VALUE>, < TRADE TYPE > AND <COMMENT>.

A.1.25.4 Equity In Transfer Transaction

‘Equity In Transfer’ monetary transaction is automatically posted by the system to update Equity to new account created as part of trade.

Equity In transaction parameters

Transaction |

Parameters |

EQUITY IN TRANSFER |

TXN DATE |

ACCOUNT NBR |

|

AMOUNT |

|

COMMENT |

|

TRADE TYPE |

On successfully posting the transaction, the ‘Equity In’ field is updated in Account Details > Trade Details screen and a comment is posted on the existing (old) account in the format ACCOUNT EQUITY IN RECEIVED ON <DATE> FROM ACCOUNT NUMBER <ACCOUNT NUMBER> WITH VALUE <VALUE>, <TRADE TYPE> AND <COMMENT>.

A.1.25.5 Trade Fix Transaction

You can rectify the equity mismatch for a failed Trade transaction and process the Equity transfer by posting TRADE FIX monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

To post Trade Fix transaction

Transaction |

Parameters |

TRADE FIX |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS LINKED ACCOUNT |

|

VALIDATE COMMON CUSTOMER |

|

TRADE FIX REASON |

|

COMMENT |

This transaction is processed in the same workflow as similar to Trade Transaction. Refer to ‘Trade Transaction’ for details. In addition, you need to select the TRADE FIX REASON from the drop-down list while posting the transaction.

On successfully posting the transaction, a comment is posted on existing (old) account in the format ACCOUNT TRADED ON <DATE> WITH TOTAL TRADE EQUITY <VALUE> WITH <TRADE TYPE>, <TRADE FIX REASON> AND <COMMENT>.

A.1.25.6 Equity in Maintenance Transaction

You can override the ‘Equity In’ adjustments that are received in new account after Trade transaction by posting ‘EQUITY IN MAINTENANCE’ monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

To post Equity in Maintenance transaction

Transaction |

Parameters |

EQUITY IN MAINTENANCE |

TXN DATE |

AMOUNT |

|

COMMENT |

On successfully posting the transaction, the value specified in ‘Amount’ field is updated to ‘Equity In’ field in Trade Details sub tab of Account Details screen and a comment is posted on existing (old) account in the format ACCOUNT EQUITY IN MAINTAINED ON <DATE> WITH VALUE <VALUE>, <REASON> AND <COMMENT>.

A.1.26 Billing Cycle Change

You can change the billing cycle/statement of a Line of credit at any point of time during servicing by posting RESCHEDULE BILL CYCLE monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

Note the following before posting the transaction:

- The ‘Billing Cycle Change’ transaction creates significant impact in the system since it impacts the schedule, dues and sensitive account data on account. Hence it is recommended to be posted with careful consideration and OFSLL is not responsible for any impact/mismatch resulting out of this change.

- The ‘Billing Cycle Change’ transaction can be posted for both Open-Ended and Close-Ended Loans (Vehicle, Home Loan, and Unsecured), Lease and Line of Credit.

- The ‘Billing Cycle Change’ transaction is applicable for all methods like IBL (Interest Bearing Loans) and Amortized Loans.

- The ‘Billing Cycle Change’ transaction is ‘not’ applicable for Pre-compute Loans and for ‘Rent Factor Method’ of lease accounts.

- In case of any error while posting the transaction, system rolls-back all the changes on the account. Refer to OFSLL Release notes available in OTN library (https://docs.oracle.com/cd/F22291_01/references.htm) for additional information on 'Billing Cycle Change' transaction validations.

To post Billing Cycle Change transaction

Transaction |

Parameters |

RESCHEDULE BILL CYCLE |

TXN DATE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts. |

|

NEW BILLING Select the billing frequency from drop-down list. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. However, this parameter has no relevance if the 'Process to Master Account' is not set to 'Y'. |

|

PRE BILL DAYS Specify the pre-bill days on account. System displays an error if the PRE BILL DAYS is retained as zero ‘0’ (default value). |

|

DUE DAY MIN Specify the minimum due day to mark-up the due days limit on account to the required standard business rules. System displays an error if the DUE DAY MIN is retained as zero ‘0’ (default value). |

|

DUE DAY MAX Specify the maximum due day to mark-up the due days limit on account to the required standard business rules. System displays an error if the DUE DAY MAX is retained as zero ‘0’ (default value). |

|

MAX DUE DAY CHANGE DAYS Specify the total number of times due date change is permitted) on account. System performs a compatibility check for selected billing cycle. System displays an error if the MAX DUE DAY CHANGE DAYS is retained as zero ‘0’ (default value). |

|

RESCHEDULE PAYMENT START DATE Select the rescheduled/next payment date from the adjoining calendar. Ensure the date selected is not less than 'Last Due Date' (Current Due Date). |

|

PAYMENT AMOUNT If payment amount is specified, then system computes billing change calculation considering system parameter. This is applicable for individual accounts. Retaining as ‘0’ (default) allows system to auto-compute new payment amount during billing change calculation. Required for Master accounts. This field has no relevance for line accounts. |

|

TERM Enter the number of payments. System displays an error if the term is retained as zero ‘0’ (default value). This field has no relevance for line accounts. |

|

RESIDUAL PERCENT REMAINING Specify a value of residual percentage to be accounted in billing. This should not be greater than Account Residual percentage. |

|

LATE CHARGE GRACE DAYS Specify the number of grace days allowed during billing change calculation. Retaining as ‘0’ (default) does not make any changes on account. |

|

LEASE EARLY TEMINATION Specify the amount to be paid for early termination. Retaining as ‘0’ (default) does not make any changes on account. |

|

COMMENTS |

For detailed information on above fields validation, computation of other transactions, 'Billing Cycle Change' transaction validations, refer to OFSLL Release notes available in OTN library (https://docs.oracle.com/cd/F22291_01/references.htm).

While posting the transaction:

- System allows 'Next Due date' after Current Due Date.

- The ‘Next Billing Date’ is computed after Current Due Date i.e. Next Due Date - Pre Bill Days.

- System allow backdating of this transaction till last due date.

- The ‘Paid Term’ is auto-computed considering the back dated payments (if any).

On successfully posting the transaction, system updates the billing changes to current/master account as defined and internally posts Due Date Change, Change Payment Amount, and Change Term transactions for new billing cycle to be established.

Billing Cycle Change Reversal

Reversal of ‘Reschedule Bill Cycle’ is allowed with following restrictions:

- System changes ‘Account back dated date’ as date of posting of transaction and hence no monetary transaction is allowed to post on or before that date. This implies, system does not allow to reverse the ‘Reschedule billing transaction’ on same date.

- System does not allow to reverse the transaction, if any monetary transaction is posted (except payoff quote), after posting reschedule billing transaction. User is expected to reverse the monetary transaction manually, to reverse the reschedule billing transaction.

A.1.27 Capitalization Maintenance

Capitalization maintenance helps to define the capitalization parameters to capitalize the corresponding account balances to principal balance based on specific frequency. For example, you can capitalize the accumulated Interest or Late Fees to principal balance of the account.

During servicing, you can either enable and define new capitalization parameters for an account or modify / disable the pre-defined capitalization parameters at any point by posting CAPITALIZATION MAINTENANCE monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

However, note that capitalization is supported only for 'Active' Accounts.

To post Capitalization Maintenance transaction

Transaction |

Parameters |

CAPITALIZATION MAINTENANCE |

TXN DATE |

|

CAPITALIZE Select either YES or NO (default) from drop-down list. |

|

BALANCE Select the type of balance to be capitalized from the drop-down list. Selecting ALL (default) capitalizes all the balances maintained for the account. |

|

FREQUENCY Select the required capitalization frequency from the drop-down list. The list contains the following types of frequency: - Based on specific intervals such as Monthly, Quarterly, Annual and so on. - Based on contract Billing Frequency, Billing Date, or Due date. - Specifically on every Month End. Note: Selecting Balance Frequency option here has no relevance for capitalization. |

|

CAP GRACE DAYS Specify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days. However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified. |

|

CAP TOLERANCE AMT Specify the capitalization tolerance amount which is the minimum amount to qualify for capitalization. Any amount less than this is not considered for capitalization of balances. This helps to avoid capitalization of nominal or decimal amounts. Note: There is no specific accounting maintained for non-capitalized decimals with reference to setup. |

|

CAPITALIZE AMT TILL DATE Select either YES or NO (default) from the drop-down list. - Yes - to capitalize the balance amount till date and continue capitalization based on defined parameters. - No - to capitalize the balance amount till date and stop capitalization. NOTE: This parameter is useful only when the capitalization preference is changed from Y to N during servicing, by posting 'Capitalization Maintenance' transaction and if the capitalization was enabled during origination. For other combinations, this parameter is ignored for processing. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) Select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

On successfully posting the transaction, system deducts the corresponding balance amount and adds to Advance / Principal or Lease receivable balance based on the defined frequency.

Accordingly, as part of capitalization process two transactions are posted on the account and the same can be viewed in Customer Service > Transaction History > Transactions tab. Also, two entries are posted in Customer Service > Balances tab indicating the balance deduction in Capitalized (-) column and principal addition in Capitalized (+) column respectively.

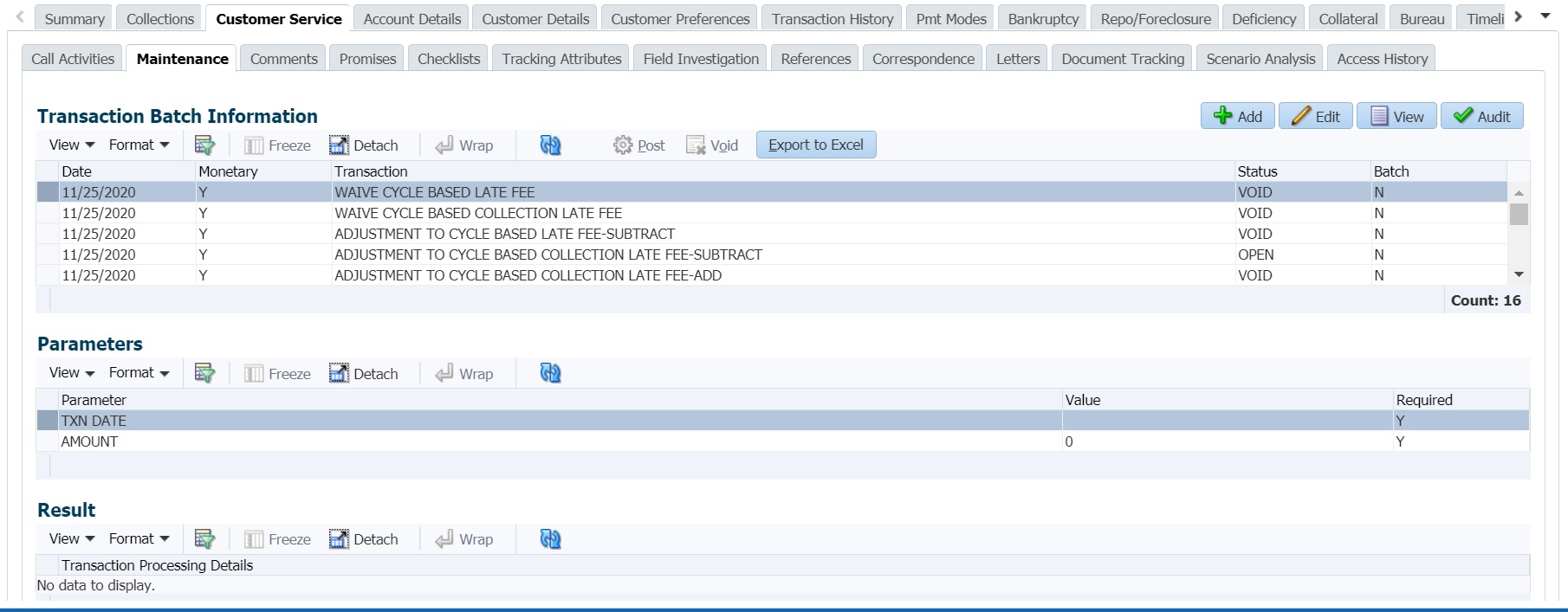

A.1.28 Cycle Based Late Fee Adjustment / Waiver

Late fee is the amount charged when payment is not made within the grace period or by the day after payment is due. The due date is determined by the contract.

Accordingly, the Cycle Based Late Fee Adjustment / Waiver is required to be done when such late fee corrections are to be posted on the account. This can be done during servicing by posting the following types of monetary transactions in Customer Service > Maintenance > Transaction Batch Information section.

To post Adjustment / Waive Maintenance transaction

Transaction |

Parameters |

ADJUSTMENT TO CYCLE BASED COLLECTION LATE FEE-ADD ADJUSTMENT TO CYCLE BASED COLLECTION LATE FEE-SUBTRACT WAIVE CYCLE BASED COLLECTION LATE FEE ADJUSTMENT TO CYCLE BASED LATE FEE-ADD ADJUSTMENT TO CYCLE BASED LATE FEE-SUBTRACT WAIVE CYCLE BASED LATE FEE |

TXN DATE Select the transaction date from adjoining calendar. |

AMOUNT Specify the amount to be adjusted / waived on the account. |

A.1.29 Fee Consolidation Maintenance

You can update and maintain Fee Consolidation to an Account during Servicing and Collection stage by posting ‘FEE CONSOLIDATION MAINTENANCE’ monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

Before posting the transaction, note that:

- The fields are updated only if the value of parameters is greater than zero.

- Transaction is allowed to be posted only those accounts which are linked to Master Account (Including Master Account).

- When Fee Consolidation at Master Account flags are checked, system validates if respective fee balance(s) are available at Master and Associated account or not. Balance validations is enforced only when both Master and Associated accounts have ‘Fee at Master Account flag = Y’.

- If the Account's billing Cycle is Monthly, Weekly, Bi-Weekly, Semi-Monthly, system validates if Late fee Grace Days > 28. Else displays an error.

- If late fee consolidation at Master is Y on Master account, then system validates if Associated Account has same respective fee grace days and fee cycle. Else displays an error.

While posting the fee consolidation on executing the scheduled batch jobs, the processing is done based on following matrix:

Flag |

Master Account (M1) |

Associated Account (A1) |

Action |

Late Charge at Master Account |

Y |

Y |

Loop through Master and Associated Accounts, Post Late Charge at Master Account and a Zero amount Late Charge transaction at Associated Account. |

Y |

N |

Loop through Master and Associated Accounts to find out that there are no Associated Account with fee at master flag = Y. Then consider only the Master Account Due Amount to calculate fee According to Fee calculation Method. |

|

N |

N |

Don’t loop through Master and Associated, Post Late Charge at Master and Associated Based on the Fee Configuration at respective account >Contracts. |

|

N |

Y |

Don’t loop through Master and Associated, Post Late Charge at Master and Associated Based on the Fee Configuration at respective account >Contracts. |

To post Fee Consolidation Maintenance transaction

Transaction |

Parameters |

FEE CONSOLIDATION MAINTENANCE |

TXN DATE Select the transaction date from adjoining calendar. |

|

LATE CHARGE AT MASTER ACCOUNT Select either Yes or No from the drop-down list. Selecting ‘Yes’ allows system to consolidate the late charge assessment at master account level. |

|

LATE CHARGE GRACE DAYS Specify the number of grace days allowed before late charge is assessed on the account. |

|

CYCLE BASED COLLECTION LATE FEE AT MASTER ACCOUNT Select either Yes or No from the drop-down list. Selecting ‘Yes’ allows system to consolidate the cycle based collection late fee assessment at master account level. |

|

CYCLE BASED COLLECTION LATE FEE GRACE DAYS Specify the number of grace days allowed before cycle based fee is assessed on the account. This field is enabled only if the Cycle Based Collection Late Fee option is checked above. |

|

CYCLE BASED LATE FEE AT MASTER ACCOUNT Select either Yes or No from the drop-down list. Selecting ‘Yes’ allows system to consolidate cycle based late fee assessment at master account level. |

|

CYCLE BASED LATE FEE GRACE DAYS Specify the number of grace days allowed before cycle based late fee is assessed on the account. |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and all Associated Accounts. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

VALIDATE PORTFOLIO COMPANY Select either Yes or No from the drop-down list to indicate the system to validate if the current selected Account and Master Account belongs to the same portfolio company. System does not allow to post the transaction if this option is selected as Yes and the portfolio company is found to be different for both accounts during validation. |

|

REASON Selected the appropriate reason code for posting this transaction from the drop-down list. |

On posting the transaction, system updates the respective indicators under ‘Fee Consolidation’ header in Customer Service > Contract screen.

A.2 Nonmonetary Transactions

This section catalogues the transaction codes and parameters required to complete the following nonmonetary tasks for Line of credit:

- Update a customer’s /Business name

- Maintain customer details

- Mark a customer/business as a skipped debtor

- Mark a customer as deceased

- Change a customer’s Privacy Opt-Out indicator

- Stop Customer/Business correspondence

- Modify financed insurance information

- ACH Maintenance

- Reprint a statement (batch only)

- Add or stop servicing of accounts with post dated checks as a repayment method

- Stop an ACH for an account

- Add ACH bank

- Cancel or adjust an ESC

- Apply a refund payment to an ESC

- Cancel insurance (or reverse the insurance cancellation)

- Add new escrow insurance details

- Add new escrow tax details

- Change insurance annual disbursement

- Change insurance disbursement plan

- Change escrow indicators of insurance

- Change insurance expiration date

- Change insurance maturity date

- Change tax annual disbursement

- Change tax disbursement plan

- Change escrow indicators of tax

- Resume escrow analysis

- Resume escrow disbursements

- Stop escrow analysis

- Stop escrow disbursements

- Refund or adjust insurance

- Adjust Dealer Compensation

- Add / Modify Account Contact References

- Account Statement Preference Mode

- Cure Letter Date Maintenance

- Customer Credit Limit Transactions

- Add Existing Customer to Account

- Add/Update Business Customer Details

- Rescission Account

- Add Asset to Account

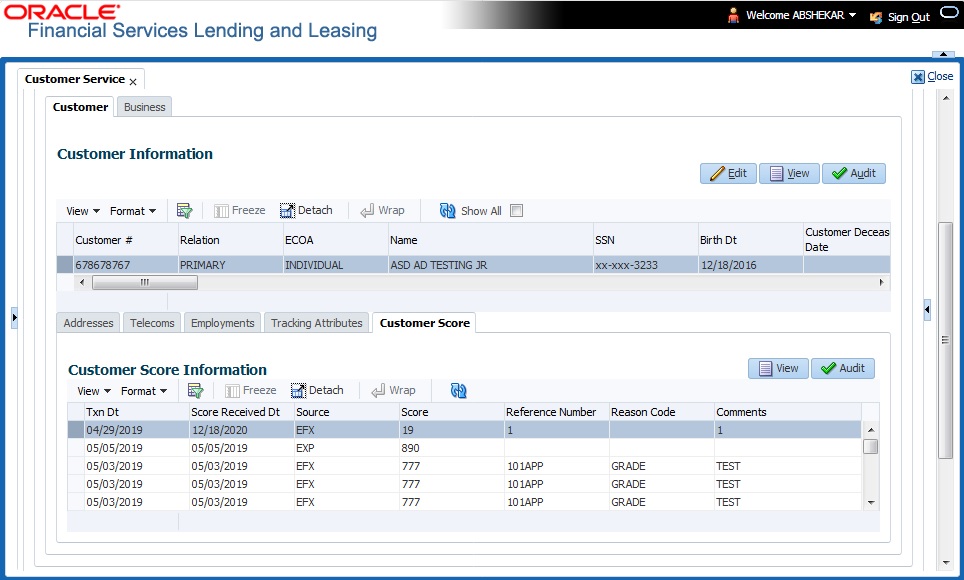

- Customer / Business Credit Score Update

- Master Account Maintenance

- Master Account - Statement Consolidation Indicator Maintenance

- Add Existing Business to Account

- Add Business Phone Details

- Confirm Customer / Business address

- Trading of Accounts - Non-Monetary Transactions

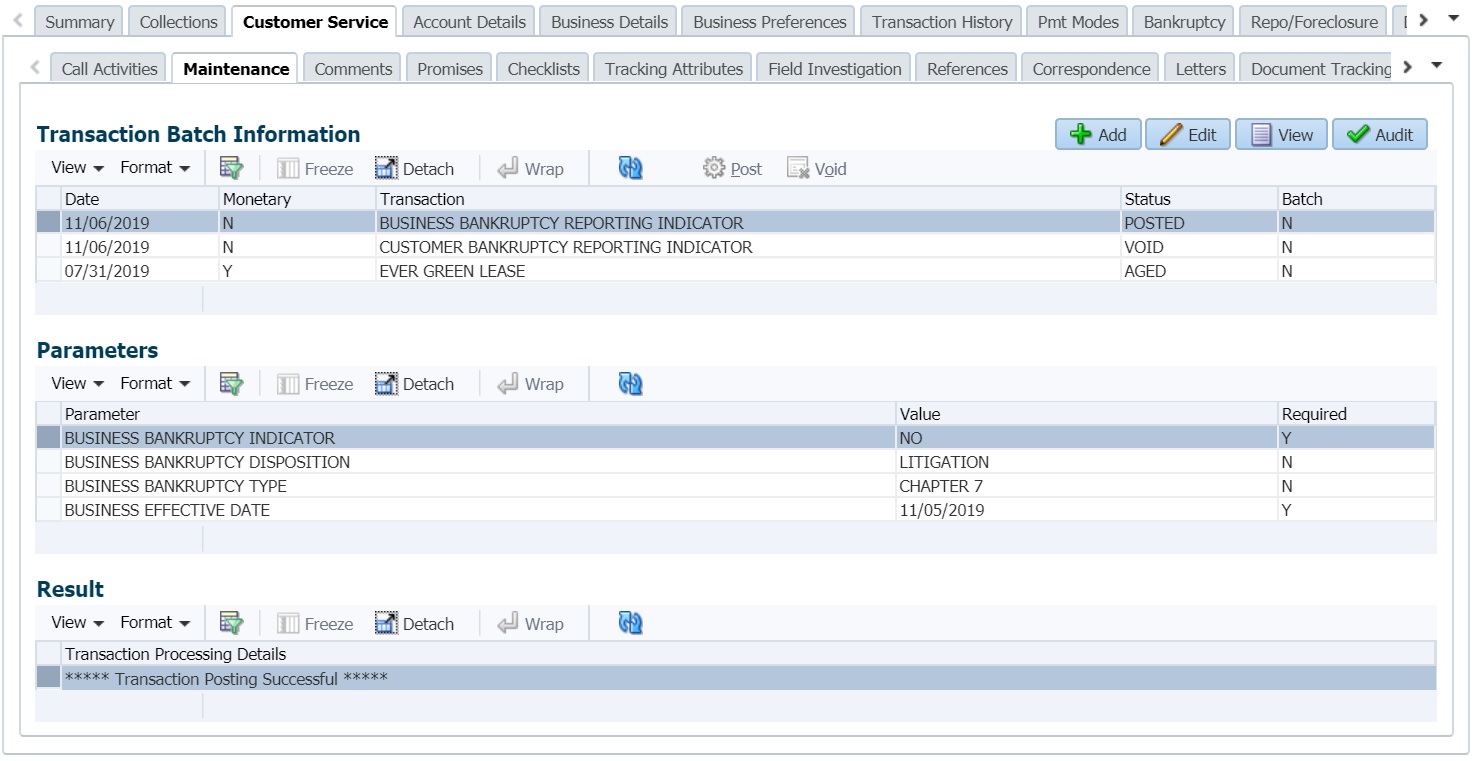

- Bankruptcy Reporting Indicator

- Collateral Maintenance

- Account Contract Maintenance

- Account Payment Mode Maintenance

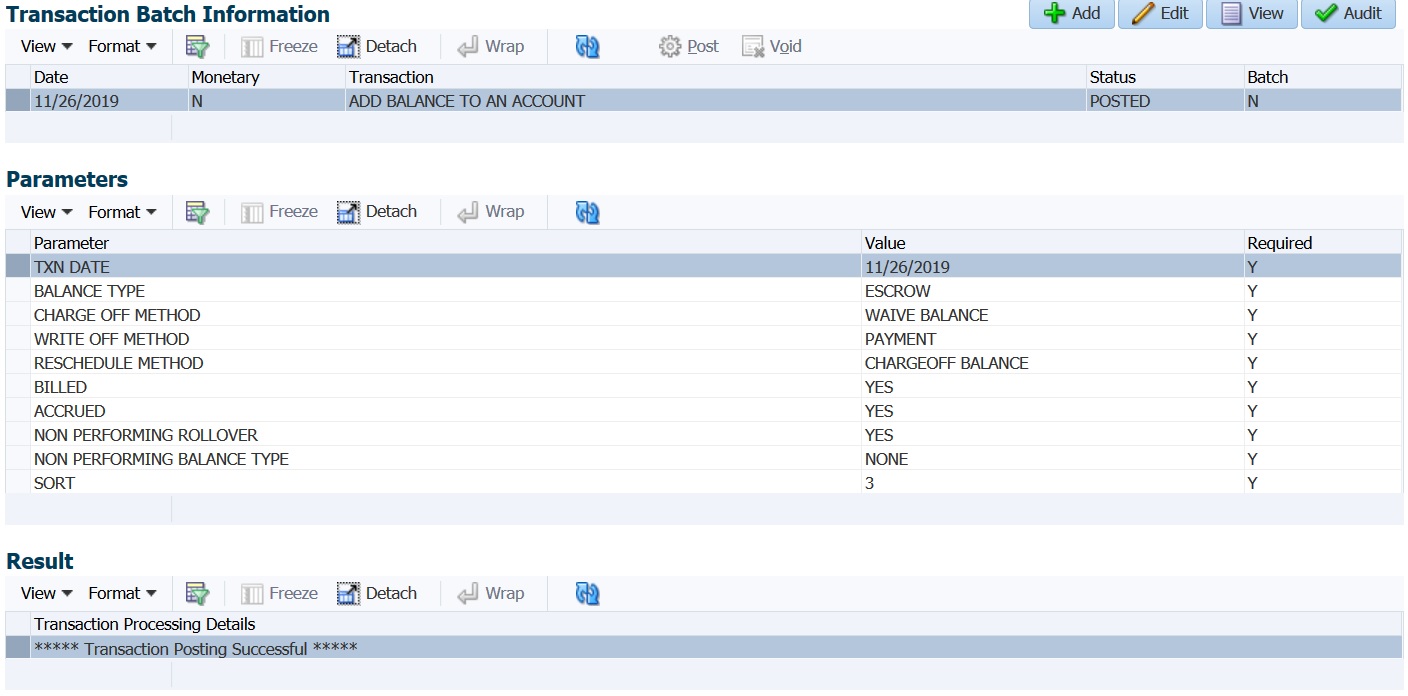

- Add Balance to Account

- Linked Account Maintenance

- Mock Statement Maintenance

- Skip Credit Bureau Reporting Maintenance

- Repossession Maintenance

- Stop Correspondence at Account Level

- Consolidated Payoff Quote

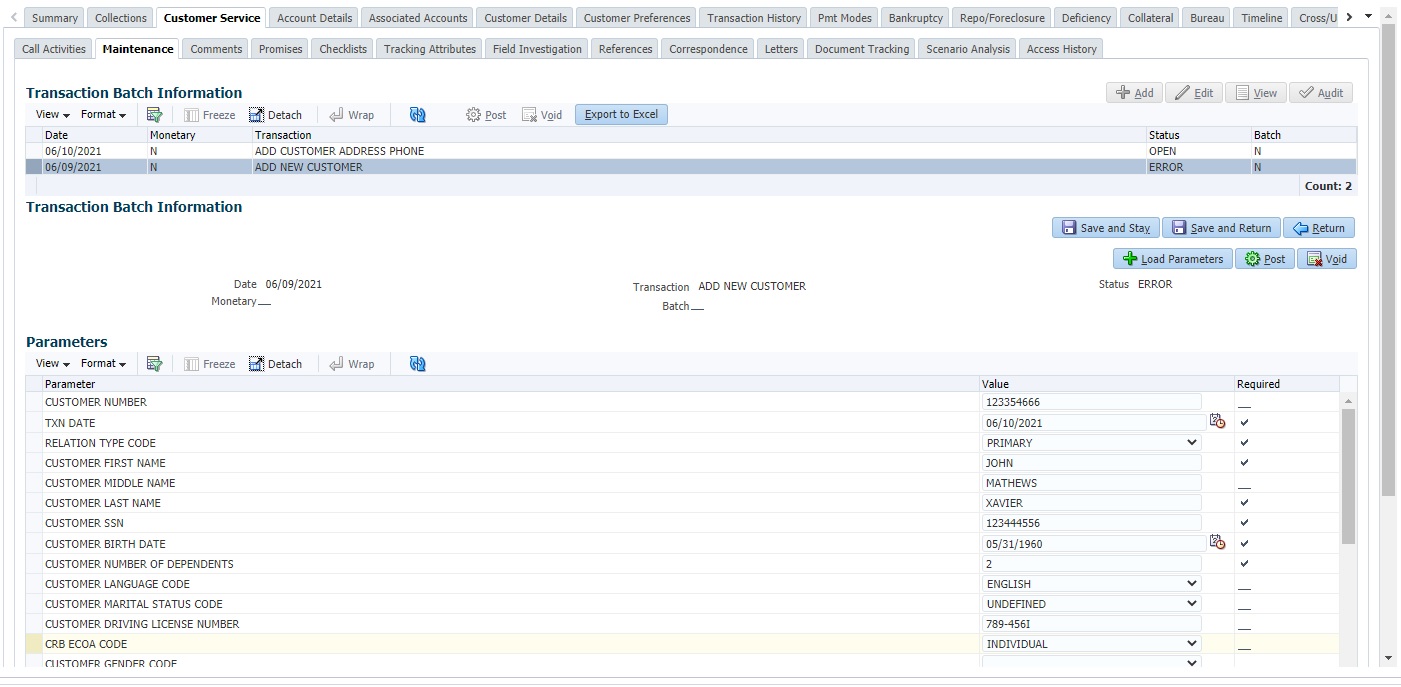

- Add New Customer

- Add/Update customer Address

- Agreement Number Maintenance

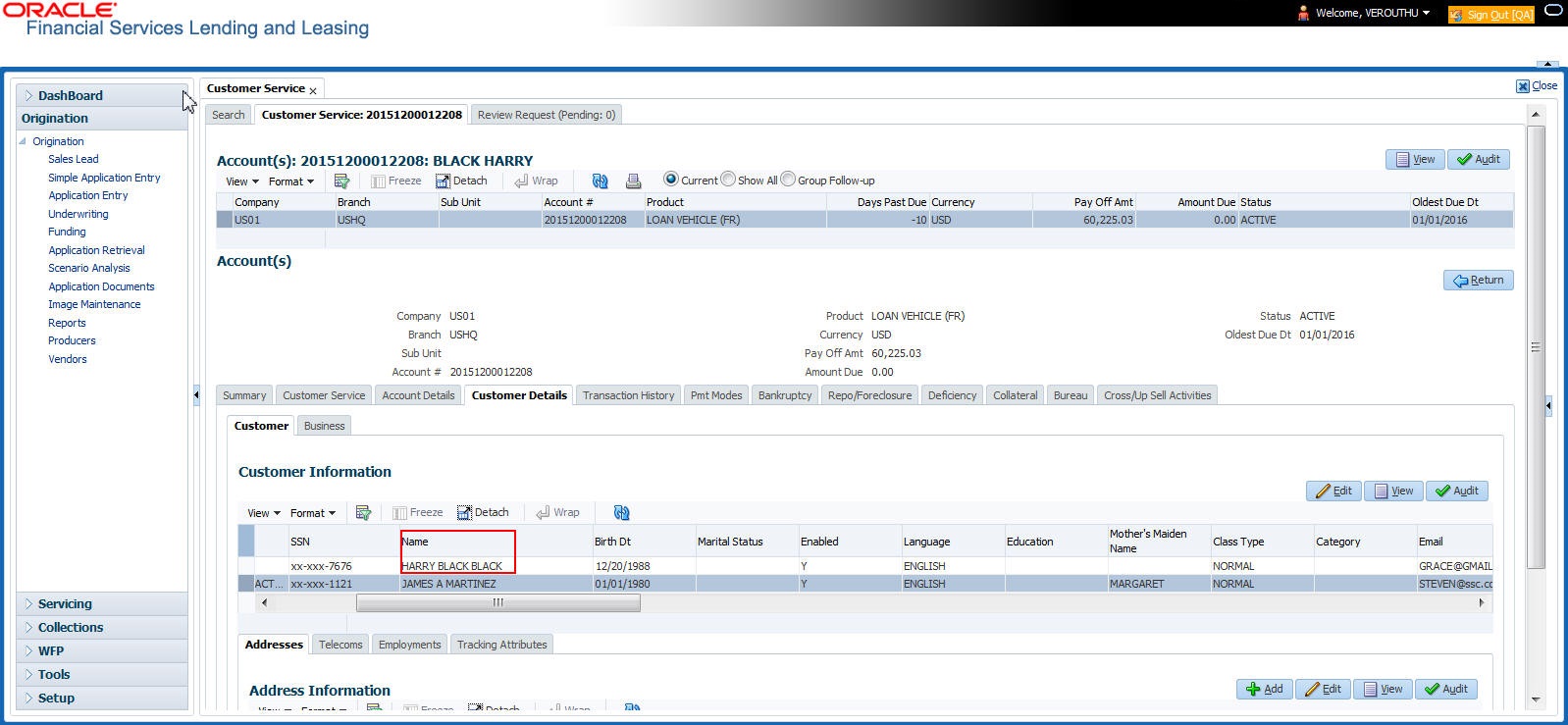

A.2.1 Customer/Business Name Maintenance

You can update and change a customer’s or Business name.

To update a customer’s name

Transaction |

Parameters |

Customer Name Maintenance |

Txn Date |

Relation Type Code |

|

Customer First Name |

|

Customer Middle Name |

|

Customer Last Name |

|

Customer Generation |

|

Code |

To update business name

Transaction |

Parameters |

BUSINESS NAME MAINTENANCE |

Txn Date |

BUSINESS NAME |

|

LEGAL NAME |

Here, the legal name is register name of the business and can be the business name itself.

The new details appear throughout the system; for example, in Customer Service screen’s Customer(s) section and Customer Details screen’s Customer section.

A.2.2 Customer Details Maintenance

You can update and change the following details regarding a customer: social security number, marital status, disability indicator, driving license number, number of dependants, and email address.

To change other details about a customer

Transaction |

Parameters |

Customer Maintenance |

Txn Date |

Relation Type Code |

|

Customer SSN |

|

Customer Marital Status Code |

|

Customer Disability Indicator |

|

Customer Driving License Number |

|

Customer Number of Dependents |

|

Customer Email Address 1 |

|

Customer Birth Date |

|

Customer Gender Code |

|

Customer Language Code |

|

Customer Driving Licence State Code |

|

Customer Time Zone |

|

Payment Hierarchy |

Note

The payment hierarchy is auto-populated by the system based on new/existing customer details and the same can be modified. For more information, refer to Payment Hierarchy field details in Customer sub tab section.

The new details appear throughout the system.

A.2.3 Skipped Customers/Business

When a customer/business cannot be located, the system enables you to mark that customer/business as “skipped” (as in, “the customer/business is a skipped debtor”) Marking a customer/Business as skipped indicates that the customer’s/business whereabouts are unknown.

To mark a customer as “skipped”

Transaction |

Parameters |

Customer Skip |

Txn Date |

Relation Type Code |

|

Customer Skip Indicator |

To mark a business as “skipped”

Transaction |

Parameters |

Business Skip |

Txn Date |

Business Skip Indicator |

The Skip box is selected on the Customer Service screen’s Customer/Business Details tab.

To remove the Skip indicator, follow the above procedure and update the ‘CUSTOMER/BUSINESS SKIP INDICATOR’ as ‘NO’.

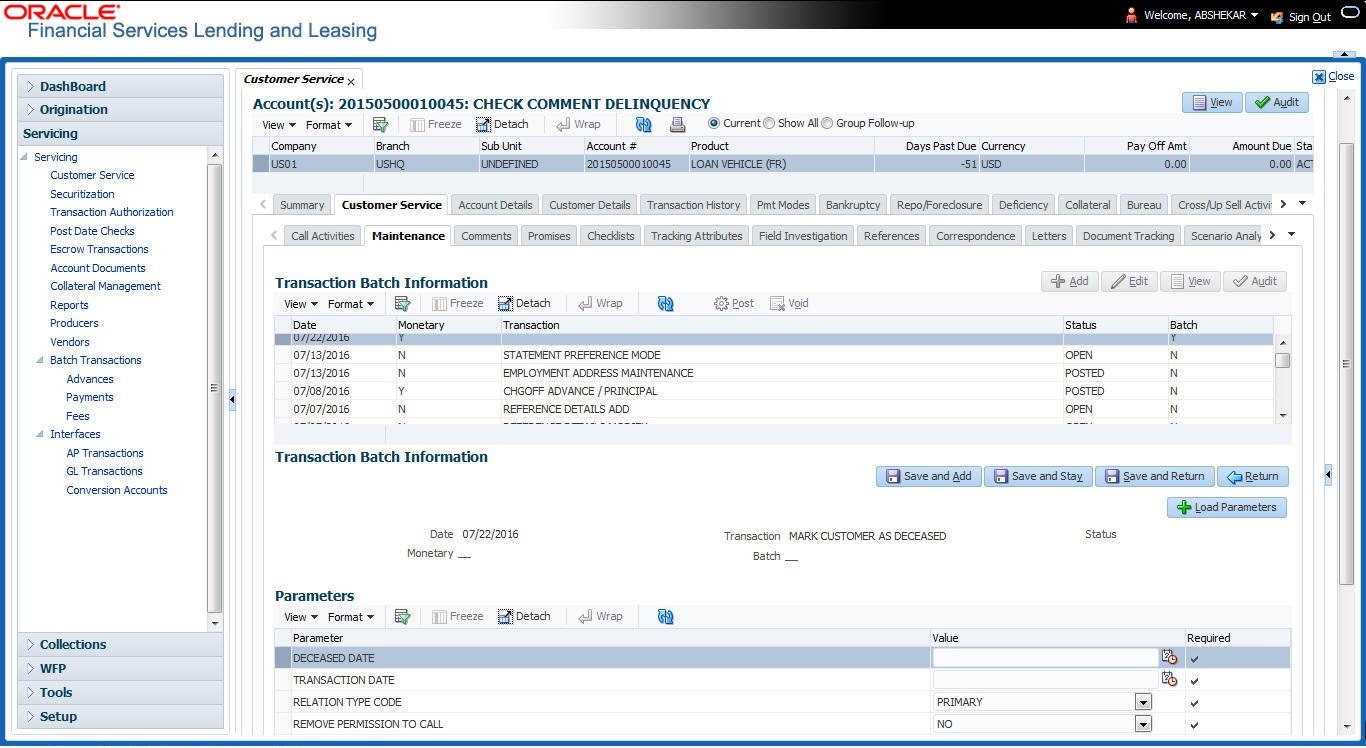

A.2.4 Mark Customer as Deceased

You can mark a particular customer as deceased by posting a non-monetary transaction. Marking a customer as deceased indicates that the 'Account holder is deceased' and this condition is posted on the account and an Alert is populated in Comments tab and Summary tab. Also when a particular customer is marked as deceased, you can change the permission to call the customer as “No” on all accounts and contacts where the customer is attached.

To mark a customer as “deceased”

Transaction |

Parameters |

MARK CUSTOMER AS DECEASED |

DECEASED DATE |

TRANSACTION DATE |

|

|

RELATION TYPE CODE |

|

REMOVE PERMISSION TO CALL |

You can select the ‘Deceased Date’ and ‘Transaction Date’ (last transaction date) from the adjoining calendar. Select the ‘Relation Type Code’ and ‘Remove Permission To Call’ (as ‘Yes’) from the drop-down list.

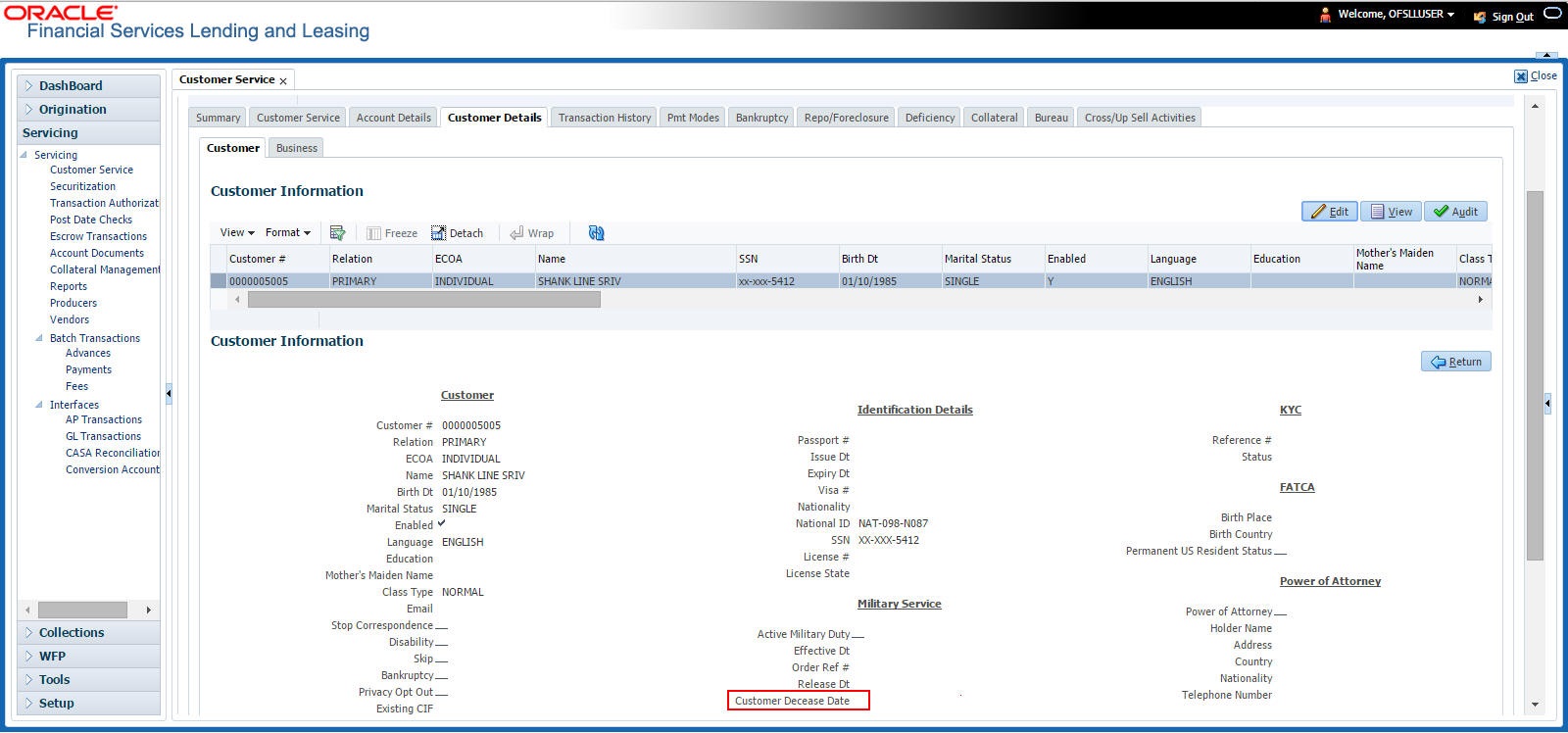

System identifies all the related accounts based on Customer ID and marks ‘the customer deceased date’ on all accounts (primary or joint holder) held by the customer. If the transaction is successful, a confirmation message is displayed in the Results section displaying all the customer accounts on which this status is posted. Also a comment is posted on all accounts when the ‘Permission to Call’ status is changed.

The Customer Deceased Date is also indicated on the Customer Details screen’s Military Service section.

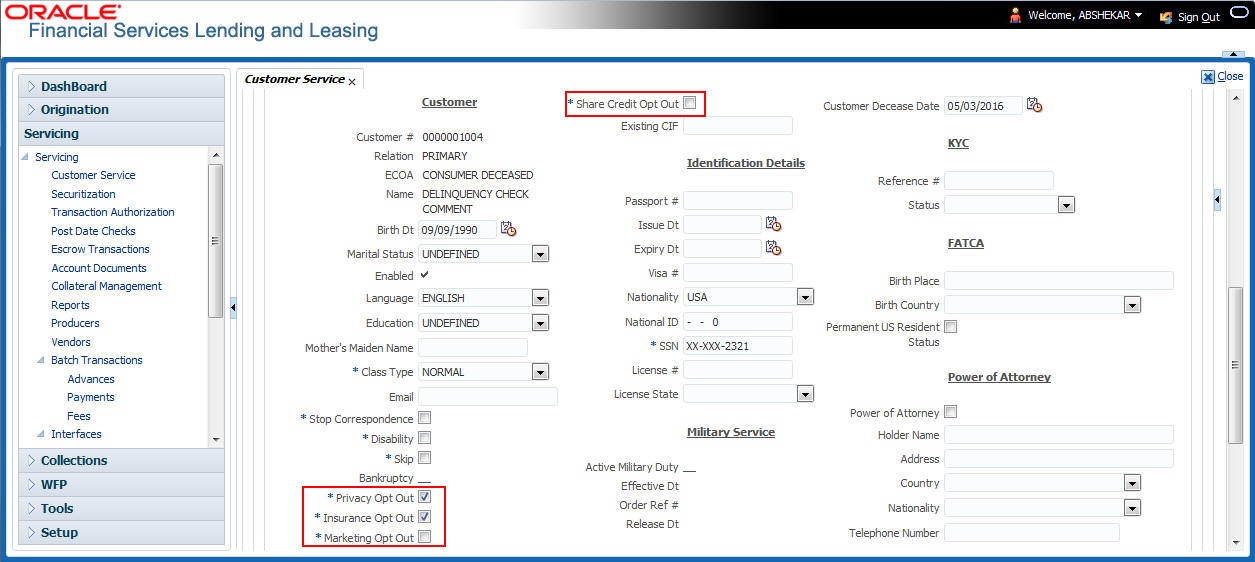

A.2.5 Privacy Opt-Out Indicator

You can change the customer’s/Business Privacy information sharing preference (Opt-Out indicators) along with other choice indicators of Insurance, Share Credit and Marketing preferences by posting the following nonmonetary transaction parameter.

Customer:

Transaction Code: CUS_PRIVACY_INFO

Description: CUSTOMER OPT-OUT PREFERENCES (PRIVACY OPT-OUT)

To change the customer’s privacy opt-out indicators

Transaction |

Parameters |

Customer Privacy Info Sharing Preference |

Transaction Date |

Relation Type Code |

|

Privacy Optout |

|

Insurance Optout |

|

Share Credit Optout |

|

Marketing Optout |

Business:

Transaction Code: BUS_PRIVACY_INFO

Description: BUSINESS OPT-OUT PREFERENCES (PRIVACY OPT-OUT)

To change the business privacy opt-out indicators

Transaction |

Parameters |

BUSINESS OPT-OUT PREFERENCES (PRIVACY OPT-OUT) |

Transaction Date |

Privacy Optout |

|

Insurance Optout |

|

Share Credit Optout |

|

Marketing Optout |

The customer’s Privacy information sharing preferences are updated on the Customer Service screen’s Customer/Business Details tab.

To remove the customer’s Privacy information sharing preferences, follow above procedure. However, you can also type N in the CUSTOMER STOP CORRESPONDENCE INDICATOR parameter.

A.2.6 Customer/Business Correspondence (stopping)

You can choose at any time to stop correspondence to a customer/business. When you do so, the customer/business will receive no correspondence of any kind from the system.

There is also a provision to stop correspondence at individual account level. For more information, refer ‘Stop Correspondence at Account Level’ section.

To stop correspondence with a customer

Transaction |

Parameters |

Customer Stop Correspondence |

Txn Data |

Relation Type Code |

|

Customer Stop Corr Indicator |

To stop correspondence with a business

Transaction |

Parameters |

Business Stop Correspondence |

Txn Data |

Business Stop Corr Indicator |

The Stop Correspondence box is selected on the Customer Service screen’s Customer/Business Details tab.

To remove the Stop Correspondence indicator, follow the above procedure and update the ‘CUSTOMER/BUSINESS STOP CORR INDICATOR’ as ‘NO’.

A.2.7 Financed Insurance (modifying)

You can change other insurance details entered on the INSURANCE ADDITION transaction with nonmonetary INSURANCE DETAILS MODIFICATION transaction. The changed insurance information can be viewed on Customer Service screen’s Insurances screen.

Note

In case any issues on existing Line of credit accounts, you can back port this functionality. Contact your account manager.

Transaction |

Parameters |

Insurance Modification |

Txn Date |

Effective Date |

|

Insurance Type |

|

Policy Effective Date Company Name |

|

Phone # 1 |

|

Extn # 1 |

|

Phone # 2 |

|

Extn # 2 |

|

Policy # |

|

Expiration Date |

|

Primary Beneficiary |

|

Secondary Beneficiary |

|

Refund Amount Received |

|

Full Refund Received |

|

Comment |

A.2.8 ACH Maintenance

The ACH maintenance transaction is for updating the existing ACH Banks details and not to define a new Ach Bank. The transaction is effective provided the ACH account no, ACH routing no, account type are matching with the existing Ach Banks details. On successful posting, the confirmation number will be generated.

To update the existing ACH bank details

Transaction |

Parameters |

ACH Maintenance and NEW ACH MAINTENANCE and ACH ONE TIME PHONE PAY |

ACH Account Number |

ACH Account Type Code |

|

ACH Payment Frequency Code |

|

ACH Status Code |

|

ACH Bank Name |

|

Bank City |

|

Bank State |

|

ACH Bank Routing Number |

|

ACH Reference Number |

|

Payment Mode |

|

Name as it Appears on Account |

|

ACH Default Indicator |

|

ACH End Date |

|

ACH Payment Amount |

|

ACH Payment Amount Excess |

|

ACH Payment Day |

|

Phone Pay Fee |

|

ACH Fee Indicator |

|

ACH Start Date |

|

Debit Date |

|

Txn Date |

Note that for an active Recurring ACH record, ensure that the payment mode is selected as AUTOPAY and for an AUTO PAY type of Payment Mode, ensure that at least one active ACH record exist.

This information appears in the ACH section of the Account Details screen.

A.2.9 Stop an ACH

To stop an ACH for an account

Transaction |

Parameters |

Stop ACH Maintenance |

Txn Date |

Oracle Financial Services Lending and Leasing clears the information on the ACH section of the Account Details screen.

A.2.10 Statement Reprinting (batch only)

You can reprint a statement of account activity by defining the starting and closing dates included within the statement.

To reprint a statement

Transaction |

Parameters |

Statement Reprint Maintenance |

Txn Date |

Statement Closing Date |

A.2.11 Add ACH Bank

You can add a new ach bank. This enables the customer to make a single payment from more than one bank or monthly payments from different banks. On successful posting, the confirmation number will be generated.

To add a new ACH bank